Need a late model ute for work and play? Your car should match your lifestyle

Finally...A Quick and Easy Way To Finance a Late Model Ute Without Draining Your Cashflow.

Your car is more than just transport—it’s a statement of success. Our AI-driven finance technology finds you the best low-rate ute loan in minutes, so you can drive the car that reflects your success—without tying up capital.

.png?width=167&height=148&name=Untitled%20design%20(15).png)

AI-Powered Rate Matching

Our technology scans 40+ lenders to find you the best low-rate finance based on your personal credit profile in minutes

.png?width=167&height=148&name=Untitled%20design%20(15).png)

Tax Advantages

Maximise deductions on depreciation, repayments, and running costs when financing through your business.

.png?width=167&height=148&name=Untitled%20design%20(15).png)

Flexible Repayments

Lower your monthly costs with balloon payment options while keeping cash flow free for growth.

.png?width=167&height=148&name=Untitled%20design%20(15).png)

4WD Work Utes Retain Value

Upgrade with ease—sell or trade at the end of your term and leverage your car’s equity.

.png?width=167&height=148&name=Untitled%20design%20(15).png)

Fast & Hassle-Free Approvals

Get pre-approved in minutes and get behind the wheel of your dream car without lengthy paperwork or delays.

.png?width=167&height=148&name=Untitled%20design%20(15).png)

Confidence That Drives Success

Walk into every client meeting feeling empowered, knowing your image reflects your expertise.

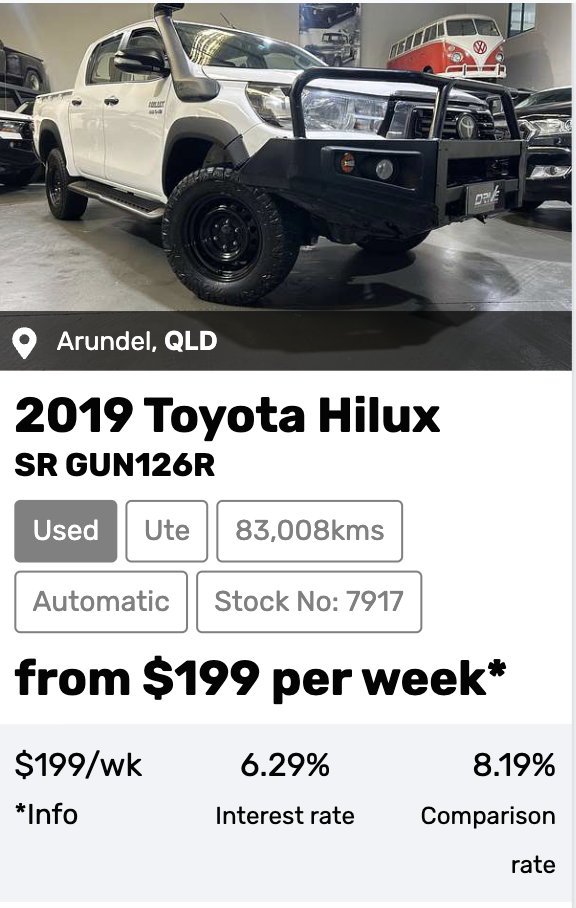

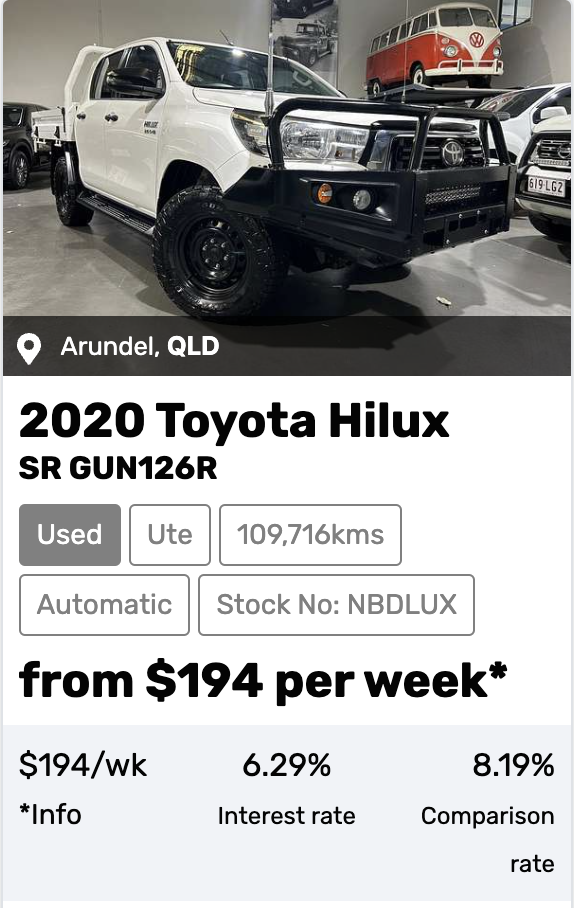

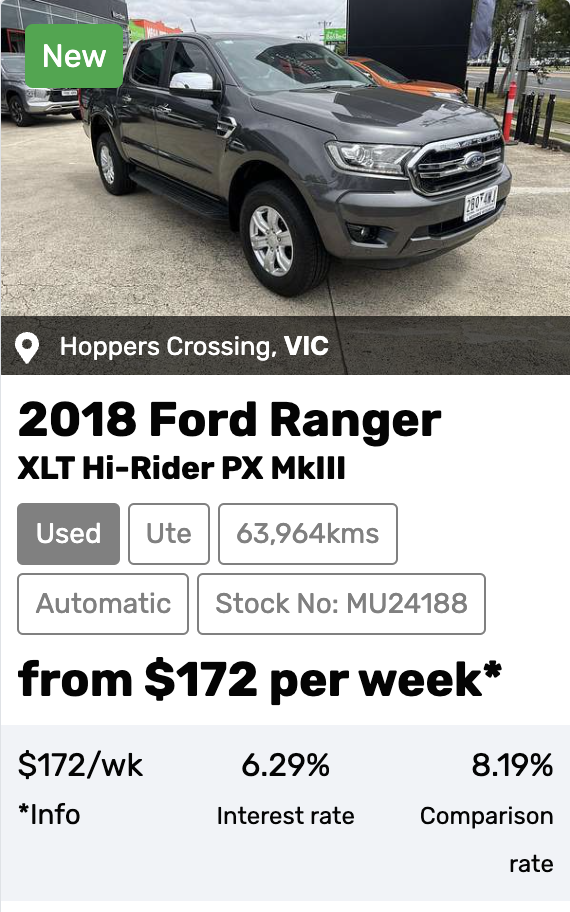

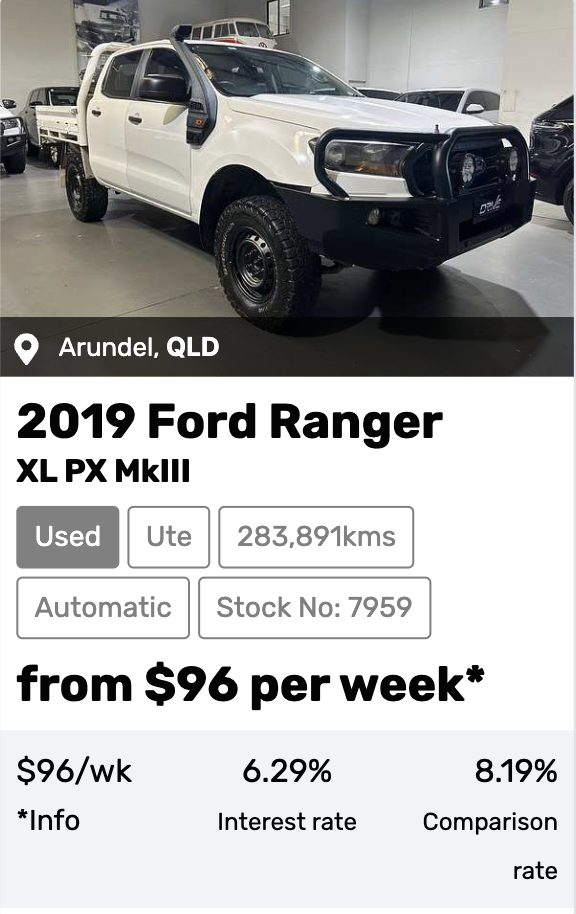

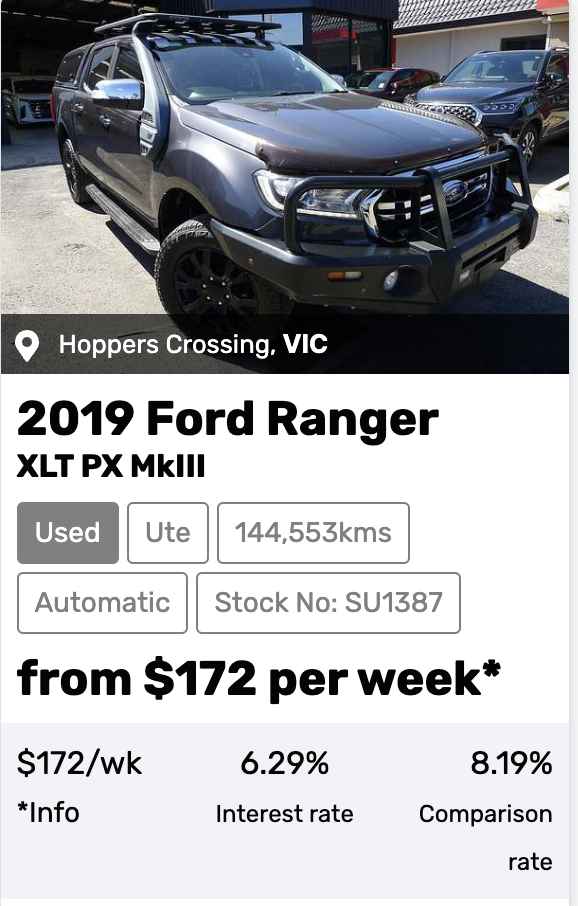

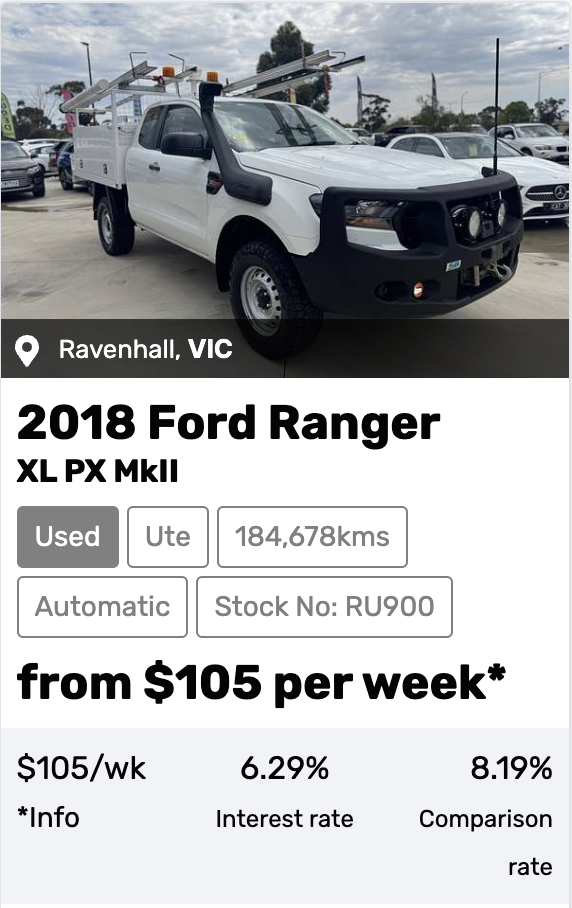

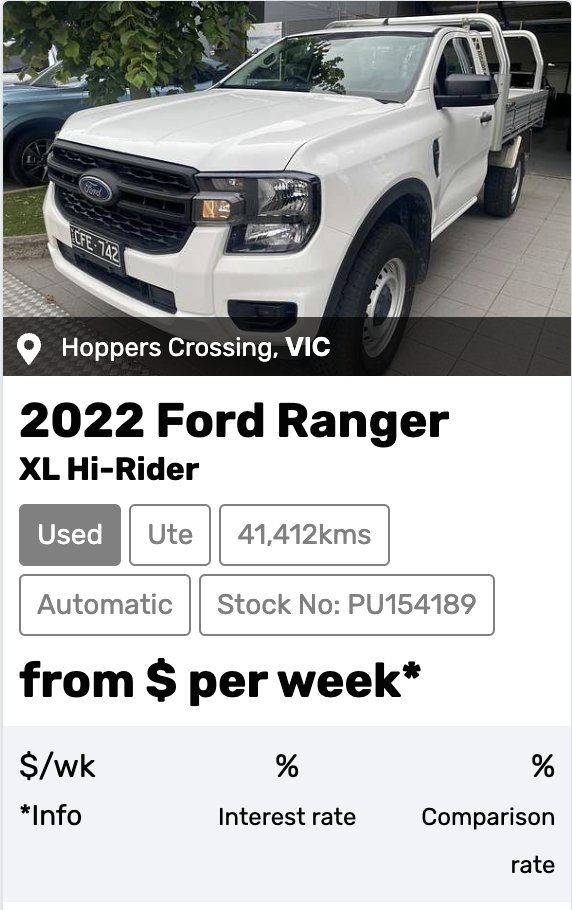

Best Deals, Easy Finance – All in One Place

Browse our top offers or just finance through us. Haven't found the ute you're looking for? Apply for finance , tell us what you want and we’ll find you the perfect match at a great price and get it delivered to your door.

Get Finance Now!

Instant pre-approval

Get Finance Now!

instant pre-approval

Get Finance Now!

instant pre-approval

Get Finance Now

instant pre-approval

Get Finance Now

instant pre-approval

Get Finance Now

instant pre-approval

Get Finance Now

instant pre-approval

Apply Now and We'll Help You Finance a New Ute This Week.

If you’re truly serious about upgrading to a late model ute we have excellent news. For a limited time only, we’re offering you a free, no-obligation session with one of our finance experts.

During your 15 minute session, we’ll discuss your current situation, what your goals are and how we can help you achieve them using our proven financing structures .

We’ll also cover a stack of valuable information together, including…

.png?width=167&height=148&name=Untitled%20design%20(15).png)

Financing Best Options

How you can drive a lat4 model work ute this week—without overspending on financing

.png?width=167&height=148&name=Untitled%20design%20(15).png)

No Deposit Finance

Why you don’t need a deposit to drive the work ute you deserve

.png?width=167&height=148&name=Untitled%20design%20(15).png)

Commercial Finance Tax Benefits

What tradies and sole traders must know about the tax benefits of commercial car financing before signing any loan agreement

There’s no cost or obligation to move forward with our service afterwards if you feel like it’s not for you. It’s simply a free information session designed to educate you and provide value to you in advance.

To discover your best rate all you have to do is click the link below and complete the simple 5-minute application.

This will give your consultant all the information they need to show you how to get behind the wheel of a new ute with a loan a tailored to suit your cashflow and budget.

Once it’s done our car finance expert will reach out to you to discuss your options and answer any questions you may have.

Join 100's of Happy Real Estate Pro's Enjoying The Benefits of Luxury Car Finance

No Paperwork

Business Cashflow

GST Credits

Tax Incentives

Balloon Payments

Business Reputation

At Ausloans we make ute finance easy.

Stop guessing which lender to choose.

With Ausloans AI we guarantee your best loan match from over 40+ lenders, maximising your approval chances — fast, easy and hassle-free.

Success stories.

Drive Success, In Your New Ute!

How our loan process works

Enter

Enter your personal information and loan requirements in our AI app and discover if you qualify for finance in minutes.

Remember, the more information you provide, the more accurate your loan options will be.

Unlock

Log into you secure loan portal to upload your supporting documents to unlock your best lending options.

With over 40 Lenders, our AI will find your best personalised loan options to match your budget and credit profile.

Choose

Finish your loan application with confidence! Our commercial finance specialists will review your options, answer all your questions and guide you toward the loan with the best chance of approval.

This step helps protect your credit score by avoiding unnecessary applications to lenders that may not be the right fit.

Start your application now and let our AI Find Your Best Rate in minutes!

Real stories, real journeys.

You late model ute loan questions answered.

To qualify for finance you need to:

- Be over 18 years old.

- Be an Australian citizen or permanent resident*

- Be currently employed**

- Earn at least $400 per week (after tax)

- Not be in an undischarged bankruptcy or part 9 debt agreement.

*We may be able to help if you have a visa with more than 2 years remaining.

**Min 1-month permanent employment (full or part-time) with continuation of the same industry (probation periods may be considered) - Or 6 months casual employment.

*** We may be able to help if you are employed full time and more than half of your bankruptcy period has passed.

Making an application is quick and easy. You just need to have the following documents ready to give to your broker:

- Drivers license

- ABN number

Or if you are employed:

- Two recent payslips

Not if you are currently in bankruptcy or a Part 9 or 10 debt agreement. However, if you are discharged or more than half of your bankruptcy period has passed we can be able to assist you. Click here for an assessment that will not damage your credit score or call on 1800 277 689 and talk to one of our experienced brokers to find a solution.

Yes, you can. If you are self employed, you can borrow 100% of your car's purchase value and include extras such as insurance and extended warranties.

Ready to experience the power of AI?

Privacy Policy | 2024-© Ausloans Pty Ltd Australian Credit License # 383 999