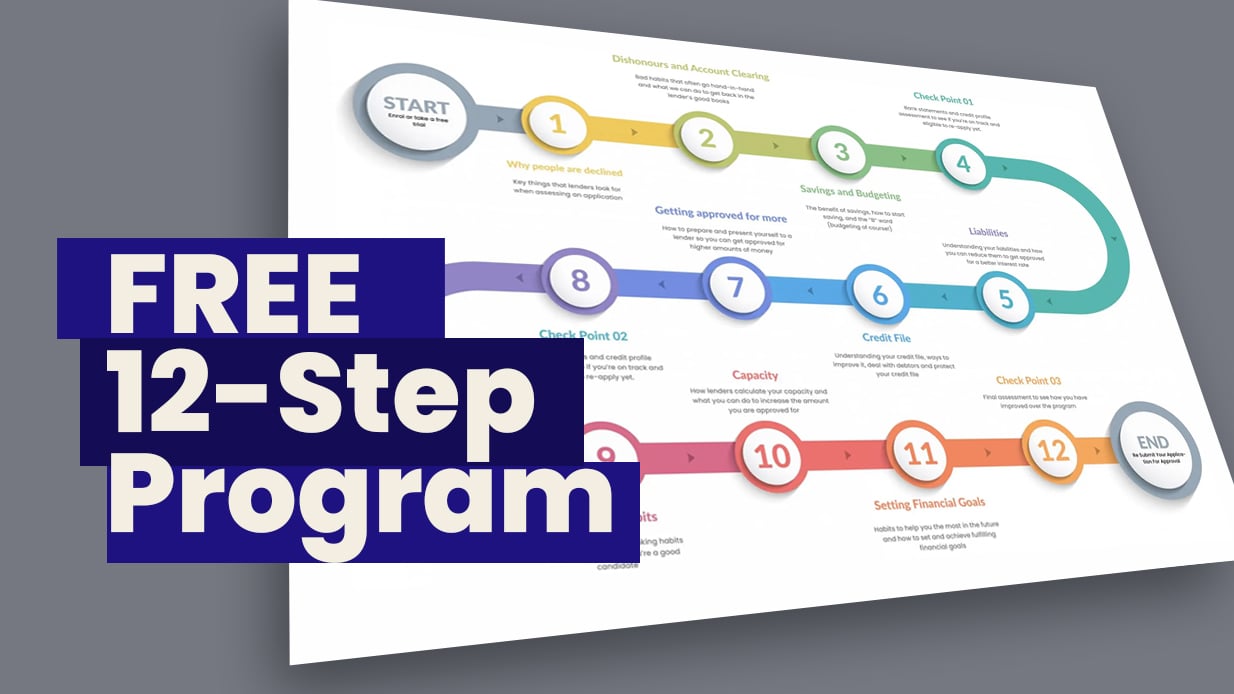

The Perfect Score program is an Ausloans initiative to help brokers get their declined clients' credit cleaned and approved for finance. For customers Perfect Score is an online program that teaches the nuts and bolts of boosting your chances of getting approved for finance, no matter your circumstances.

If you're a customer struggling with bad credit visit Perfect Score to learn how the program can work for you.

Cost: No upfront Fee to brokers | Success Cost: 30% of settlement |How Billed: monthly RCTI

Perfect Score where the aim of the game is to get your declined clients approved in 90 days or sooner. We give your customers the tools they need to get approved or lower interest rates. We teach them what lenders look for and how to get a suitable

approval.

Grow your business with Ausloans ...

Simply give us the green light to send all of your customers to the program and that's it. There is no other work required on your behalf. Here's the process.

When you client is declined for credit reasons they will automatically be referred to Perfect Score through a Zink automation

We will add your broker pod to the perfect score automation workflow. Now when your customers are declined they will automatically be invited into the perfect score program.

Once you client has opted-in to Perfect Score you will receive an email to advise and be kept uo to date with their progress in credit repair.

Finance-ready customers who complete perfect score will be returned to your work basket. Only if they settle will you be charged a service fee.

Grow your business with Ausloans ...

Ausloans Finance Group is a member of the Finance Brokers Association of Australia (FBAA), Credit Ombudsman Services Limited (COSL) and the Franchise Council of Australia (FCA).

Ausloans Finance Group entered the market in 2009 and has grown to 3 brands within the group to offer partner brokers and dealerships a holistic approach to financing.