Share this

Personal Loans - A Complete Guide to Personal Loans

by Piera Rossi on Feb 25, 2022 8:46:38 AM

Navigating the financial landscape of personal loans can be daunting, but this comprehensive guide aims to make it simple and straightforward. Whether you're looking to consolidate debt, finance a holiday, or manage unexpected expenses, understanding the ins and outs of personal loans can help you make informed decisions.

Here is a complete guide to Australian personal loans.

What Is a Personal Loan?

Let's go back to the basics: what is a personal loan? Well, it's essentially what's on the tin. A personal loan is a loan from a lender intended for personal use. The size of your loan, interest rates, and type all depends on you. You might choose a fixed loan of $40,000 that's secured against an asset, such as your car. Or, you could opt for a $2000 variable loan with no collateral.

The great thing about personal loans is their flexibility. You can design a loan plan entirely suited to your financial needs and use the money for whatever purchase you choose. Of course, loan options and lengths depend somewhat on what the lender is willing to offer. A personal loan might be the perfect solution for when you need some extra cash.

Is a Personal Loan Different From Mortgages or Credit Cards?

Personal loans are forms of credit. However, they differ from mortgages and credit cards. Mortgages are taken out to buy a high-value asset, such as your house. It's measured in decades and takes as long to pay off. Mortgages are secured against your home, and you typically need a deposit to get approved.

Credit cards, on the other hand, are like open-ended loans. You can spend up to your maximum credit limit and pay it off as often as you like. Accordingly, credit card payments vary from month to month, depending on your spending.

Personal loans are not open-ended, nor do they last upwards of twenty years. Generally speaking, personal loans last less than a decade, and you pay a set amount back each month.

Types of Personal Loans

There are two types of personal loans: secured or unsecured. The difference is that you put up an asset as collateral with secured loans. Like buying a house, you might put up your car as security against a personal loan. Therefore, if you default on any repayments, the lender has the legal right to possess your vehicle (or other assets) to make up for the shortfall.

That said, if you have an unsecured loan—where nothing is used as collateral—it doesn't mean there aren't any legal consequences to not repaying your loan. Additionally, lenders might hike up interest rates or other fees to compensate for lending risk without security.

Secured Loans

As discussed, secured loans are when you put up an asset as collateral against the cost of the loan. The standard assets are:

- Your car

- Your home

- Cash in a savings account

- Boat

- Stocks

- Bonds

- Insurance policy

- Jewellery

- Fine art

- Antiques and collectables

- Precious metals

- Future paychecks

Generally speaking, the collateral should be of equal value to the loan. If you were to stop repaying your loan for whatever reason, the lender would repossess your asset. For some assets, such as cars, jewellery, and other tangible items, the lender would sell them at auction to make their money back.

Secured loans are less risky for the lender. Accordingly, they generally have lower interest rates and better terms. On the other hand, secured loans often have stricter spending restrictions. Often the asset you're purchasing with the loan is used as security.

For example, if you take out a personal loan using your new car as collateral, the lender might require that you spend the total cost of the loan on the vehicle.

Pros of Secured Loans:

- Lower interest rates

- Higher borrowing limits

- Longer repayment terms

- Easier approval, even with poor credit

Cons of Secured Loans:

- Risk of losing assets if you default

- Potential for longer debt cycles

- Loan processing time can be longer

Unsecured Loans

Unsecured loans are the opposite. You borrow money without securing any asset as collateral. The lender often imposes higher interest rates as unsecured loans are higher risk. Additionally, they might not offer an unsecured loan to a bad credit borrower. If this is your first loan, you may need to provide a guarantor—this can also help reduce interest rates.

The upside of an unsecured loan is that you'll have the freedom to spend the money however you choose. You could use it for holidays, weddings, emergencies, or home improvements. It's flexible.

So, what happens if you stop repaying your loan? While the lender cannot repossess any of your assets, you're not free from retribution. If you cannot repay the money, the lender can take you to court to get back the money. As a result, you should always make sure you can afford any loan you decide to take out.

Pros of Unsecured Loans:

- No collateral required

- Faster approval process

- Flexibility in use

Cons of Unsecured Loans:

- Higher interest rates

- Smaller loan amounts

- Stricter credit requirements

- Potential for higher penalties and fees

Personal Loans for Debt Consolidation

Debt consolidation is a strategic way to manage multiple high-interest debts by combining them into a single personal loan. This can simplify your financial obligations and potentially reduce your overall interest payments.

Benefits of Debt Consolidation:

- Unified debt management

- Easier budgeting with one monthly payment

- Potential for lower interest rates

- Clear end date for debt repayment

How It Works:

- Assessment of Current Debts: List all your current debts, including their interest rates and balances.

- Research: Compare personal loan options to find a lower interest rate than your average current rate.

- Application: Apply for a personal loan and get approved based on your creditworthiness.

- Debt Repayment: Use the loan to pay off your various existing debts.

- Repayment Plan: Pay off the new personal loan according to the agreed terms.

Using a Personal Loan for Holiday Adventures

Personal loans can also be used to finance holidays, allowing you to travel now and pay later. This can be a convenient way to manage travel expenses without draining your savings.

Why Consider It?

- Flexibility: Unsecured holiday loans don’t require collateral.

- Quick Approvals: Funds can be available quickly, often within a day.

- Payment Plans: Choose a plan that fits your monthly budget.

Tips and Tricks:

- Research and compare loan options.

- Understand the terms, including monthly repayments and additional fees.

- Budget carefully to avoid borrowing more than necessary.

Things to Watch Out For:

- High-interest rates

- Early repayment fees

- Impact on your credit score if you miss payments

Personal Loans for Self-Employed

Self-employed individuals may face unique challenges when applying for personal loans, but there are options available from both mainstream and specialist lenders.

Requirements:

- Up to three years worth of tax returns, bank statements, and other financial documentation.

- Proof of business income and expenses.

Bad Credit Personal Loans

Even with a poor credit score, you can still qualify for a personal loan, although you may face higher interest rates and stricter terms.

Options:

- Secured loans with collateral

- Guarantor loans, where someone else guarantees your loan

Improving Your Credit Score:

- Make payments on time

- Reduce credit applications

- Lower your credit utilization

Personal Loans Interest Rates

You don't just repay the amount you borrowed (the principal) when you take out a loan. The lender will also require you to pay interest. Almost every loan you come across will have interest repayments on top of the principle.

There are two types of interest rates: fixed-rate or variable rate loans.

Fixed-Rate Loans:

As the name suggests, a fixed-rate loan is a fixed interest payment throughout the loan's lifetime. Many personal loans are fixed rates. The good thing is that you can predict your monthly repayments and factor them into your budget. Say you have a fixed rate of 8% on a five-year loan of $10,000. Your monthly repayments would be $203 every single month.

Variable-Rate Loans:

A variable rate loan has fluctuating interest rates from month to month. The RBA sets the cash rate on the first Tuesday of every month (except January). When this rises or drops, this influences the interest rates lenders charge borrowers. Say you start with an interest rate of 8%. If the RBA raises the cash rate by 0.5%, your interest repayments will increase similarly.

The advantage of a variable rate loan is that your repayments drop when the cash rate drops. If you're paying a fixed rate, you may end up giving away more money. However, the risk with a variable loan is that interest rates will go up and your payments with it.

Other Loan Fees

Unfortunately, the costs don't stop with interest payments. Ensure you read the fine print of your loan agreement to avoid any nasty surprises. Most loans come with many additional costs—you can't always get out of them. These might include an application fee, account handling fees, late payment fees, and charges for early repayment.

Check out the comparison rates of different loans. This is where you can find the actual cost. Often loans with lower interest rates seem attractive but can be more expensive when you factor in additional fees.

What Can I Use a Personal Loan For?

Unlike a mortgage or car loan that has to be used for a house or car, you should be able to use your personal loan for just about anything. Note that secured loans may have some restrictions. You may need to check how you can spend the money before committing yourself. However, an unsecured loan is as flexible as they come.

Commonly, borrowers spend their personal loans on:

- Buying a new car

- Making a home improvement or renovation

- Paying medical bills

- Paying for education

- Funding a holiday or travel

- Paying for a wedding or other big event

- Consolidating debt.

Even if there are no restrictions on how you spend your money, the lender might ask anyway. Typically, this is to ensure your creditworthiness as a borrower. For example, they might be more hesitant about offering unsecured, low-interest rate loans to you if you plan to consolidate debt.

However, as long as you're confident that you can repay the loan, you're free to spend the money wherever you choose.

Can I Use a Personal Loan to Buy a Car?

One of the most common uses of personal loans is to buy new or used cars. Car loans are typically secured against the vehicle. For older used cars, lenders might not offer secured loans. This is because the car's value is not worth the cost of the loan if they were to resell it. Generally speaking, this refers to cars that will be older than 12 years by the time the loan is up.

You must shop around for the best car loan to ensure you get the best deal. You can go to a car dealership, bank, or specialist broker. Dealerships don't always offer the best loan options as they tend to work with just one lender. Similarly, if you go directly to the bank, they might not set out reasonable terms.

On the other hand, if you go through a broker, you can guarantee they have your best interests at heart.

Alternatives to Personal Loans

If you require cash quickly, personal loans are not your only option.

Firstly, you could consider applying for a credit card. As we mentioned, credit cards offer a maximum spending limit each month. If you repay the credit in time, you won't need to pay interest. If you only need a small amount of money, opening a credit card account might be a more sensible choice than taking out a personal loan.

Secondly, you might be able to negotiate an overdraft on your transaction account with your bank. Like credit cards, you'll be able to spend more money than you have in the account. However, you will have to pay interest—but only on the money you use.

The interest rate might be higher than a personal loan. Yet, it could be suitable if you're unsure how much you need and think you can pay it back quickly.

Personal Loans for Self-Employed

Are you wondering if you're eligible for a personal loan if you're self-employed? Well, the answer is yes. And, you'll likely have a range of options to choose from—both mainstream and specialist lenders offer self-employed personal loans. It's worth keeping in mind that a broker will help you get your documentation together to meet the requirements.

To apply for a personal loan as a self-employed borrower, you'll need up to three years worth of the following:

- Tax returns

- Bank statements

- Evidence of addresses

- Proof of rental income

- Details of any shareholdings and dividend payments

- Information about your business

Bad Credit Personal Loans

Again, it's not impossible to qualify for a personal loan if you have bad credit. It's not always your fault that your credit score dips. Indeed, those without any credit score (first-time borrowers) are often penalised by mainstream lenders.

As a result, you may need to think about applying for a Bad Credit Personal Loan. This is a broad term to describe any loan designed for those with poor or no credit scores.

Generally speaking, bad credit loans might be secured only and have higher interest rates to account for the level of risk. However, if you can supply enough documentation about your financial reliability, you may get away with lower rates.

You might also want to think about improving your credit score. By making payments on time, reducing your credit applications, and lowering your credit utilisation, you could soon scrape back a few more credit points.

Loan Guarantor

The other option is to take out a guarantor loan. This is essentially like a secured loan. However, you use your guarantor as security rather than one of your assets. If you have a friend or family member who is willing to act as a guarantor for your personal loan, you might be able to lower your interest rates and get better loan terms.

Before going ahead with this type of loan, make sure both you and your guarantor understand the risks involved.

Will Applying for a Personal Loan Affect My Credit Rating?

When you apply for any loan, the lender will check your credit score. Upon your initial application, they should only conduct a soft inquiry. This won't have any impact on your score. They'll use this to approve your loan application conditionally.

However, the lender will complete a hard inquiry when you decide to proceed with the loan. This will cause your credit score to dip slightly. Therefore, it's a bad idea to apply for lots of loans within a short space of time. Lenders will see that you're struggling with debt and may reject you, which can have an even worse impact on your credit score.

How to Get the Best Deal on Your Personal Loan

While a personal loan might not be as significant a financial burden as a mortgage, it is still crucial that you get the best possible deal. You should consider seeking the help of a broker. Their expertise will help you avoid any bad loan terms. Plus, they can help you avoid the time-consuming task of shopping around.

However, if you choose to go it alone, follow our steps.

Identify Your Needs

Firstly, you need to identify why you need money. What are you using the personal loan for? For example, if you only need a small sum to catch up on energy bills, you might think about using a credit card or overdraft. In comparison, a personal loan might be the right choice for slightly larger sums.

Ask yourself the following questions:

- Do you need flexible access to the money?

- Do you have any assets you're willing to secure against the loan?

- Do you need regular and consistent repayments to manage your budget?

- Would you prefer the flexibility of a variable rate loan?

Your answers should narrow down the loan options suitable to you. It's worth bearing in mind that you can't use every loan option for any purpose. For example, it's unlikely you'll be able to use a secured loan for debt consolidation.

Credit Rating

Now you need to work out your eligibility. Take a look at your credit rating. As we mentioned, credit rating isn't the be-all and end-all of personal loans. Even if you could improve your score, many lenders are willing to offer money to those with bad or no credit.

On top of credit scores, you need to check whether you're eligible for a loan. If you're self-employed, you may need to apply for a specialist loan. In such instances, you may need to show additional documentation, such as proof of income, to secure your loan.

Research Your Options

It's time to shop around. Arguably everyone's least favourite part of applying for a loan. However, it's an essential step. When comparing personal loans, remember to look at more than just the interest rate. Comparison rates combine interest with other fees to reveal the actual cost.

To speed up the process, simply rank your personal loan shortlist by order of comparison rate.

You should also consider the loan term. While it might be tempting to reduce your monthly repayments with a longer loan, it could work out more expensive in the long term. This is because you'll be charged interest for every day of the loan's lifetime. If you can comfortably afford to reduce the loan term with higher monthly payments, it's a good idea.

Make Your Choice

Now you have your shortlisted options, making your choice doesn't have to be challenging. It's time to go back to your answers in the first step. While you might have found a low-cost, low interest-rate loan, is it right for you?

For example, if you don't have an asset to secure against the cost of the loan, you may not qualify for the loan you've found. Moreover, if you want the peace of mind of a fixed-rate loan, make sure that you can repay the monthly instalments. Sometimes interest rates are higher on fixed-rate loans than on variable loans.

Weigh up whether each loan suits your personal situation. Work out the amount you want to borrow and whether you can afford the monthly repayments.

How Do You Apply?

It's straightforward to apply. Start your application online once you've chosen the type of loan you want. The lender will ask you to upload your supporting documents. You can do this straight from your phone or computer. The lender will get back to you with personalised rates—almost immediately. Then you're only moments away from getting approved.

Paying off Your Loan

Once you've signed on the dotted line, you need to make sure you can meet each monthly repayment. It's time to create a budget. This is an excellent way to stay on top of your loan repayments. Calculate all your usual expenses—shopping, energy bills, rent, etc. Make sure you factor in your personal loan repayments.

Moreover, you can determine whether you can make extra repayments, a great way to pay your loan off early and save yourself in interest. Although, check whether there is an early exit penalty first.

It might be sensible to set reminders for when you need to pay. If you miss a payment or it is late, the lender will probably charge a missed payment fee.

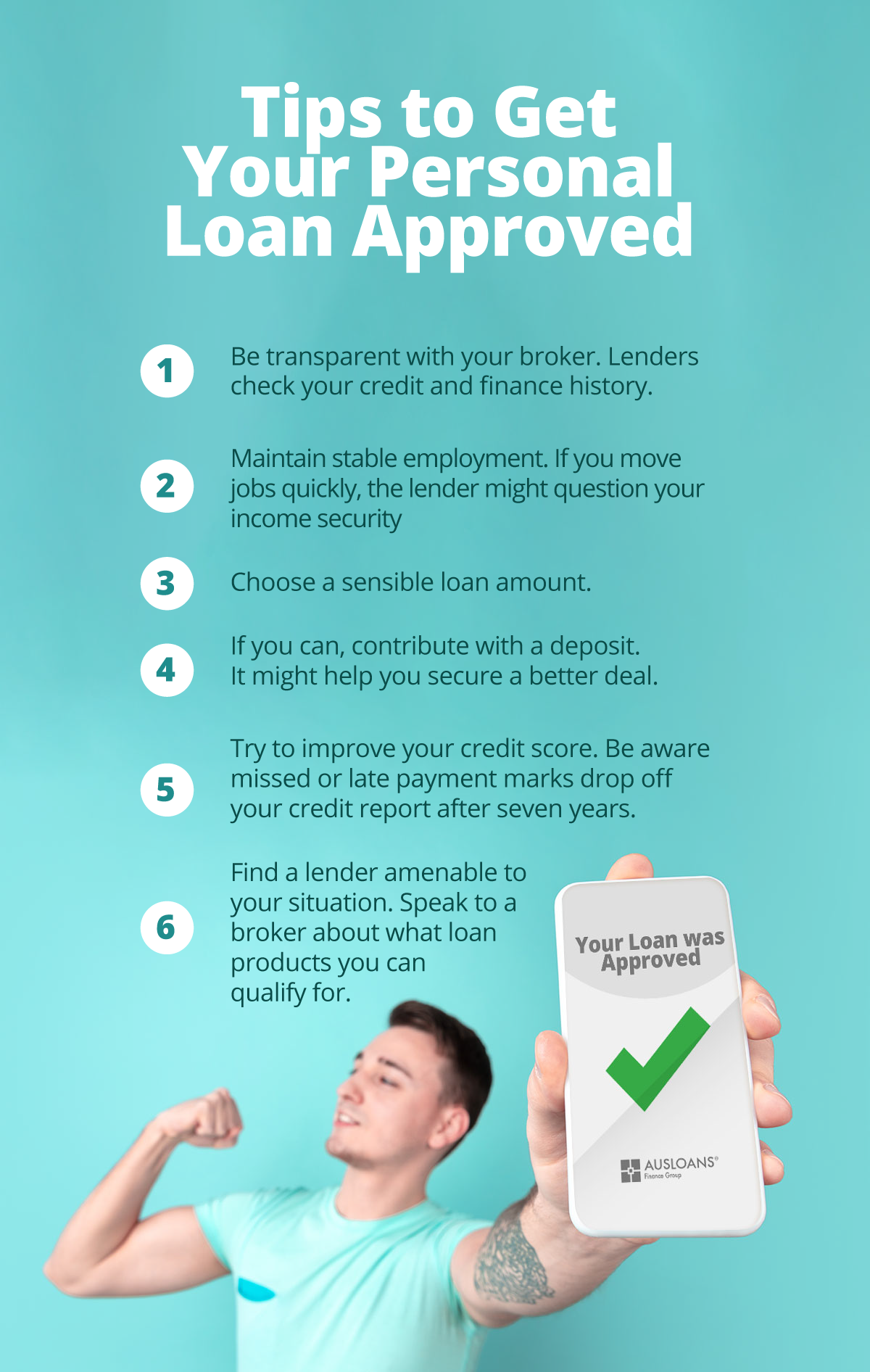

Tips to Get Your Personal Loan Approved

- Make sure your loan application is accurate and honest. If you go through a broker, ensure you're transparent with them. Lenders check your credit and finance history—any surprises will affect your credibility.

- Maintain stable employment. Lenders want to know that you're a low-risk applicant. If you have a minimum of six months with the same job, then they'll assume you're a safe bet. If you move jobs quickly, the lender might question your income security.

- Choose a sensible loan amount. If you have poor credit, the lender will probably restrict how much you can borrow. If you apply for a large loan, you probably won't get approval.

- While you don't need a deposit for a personal or car loan, it might help you secure a better deal. Alternatively, if you're taking out a car loan, trading in your old vehicle might count as a down payment.

- Try to improve your credit score. Sometimes the best thing you can do is nothing. As missed or late payment marks drop off your credit report after seven years, it should improve with time.

- Find a lender amenable to your situation. If you’re self-employed or have a poor credit history, don’t apply for loans you’re not eligible for. If in doubt, speak to a broker about what loan products you can qualify for.

Pros and Cons of Taking Out a Personal Loan

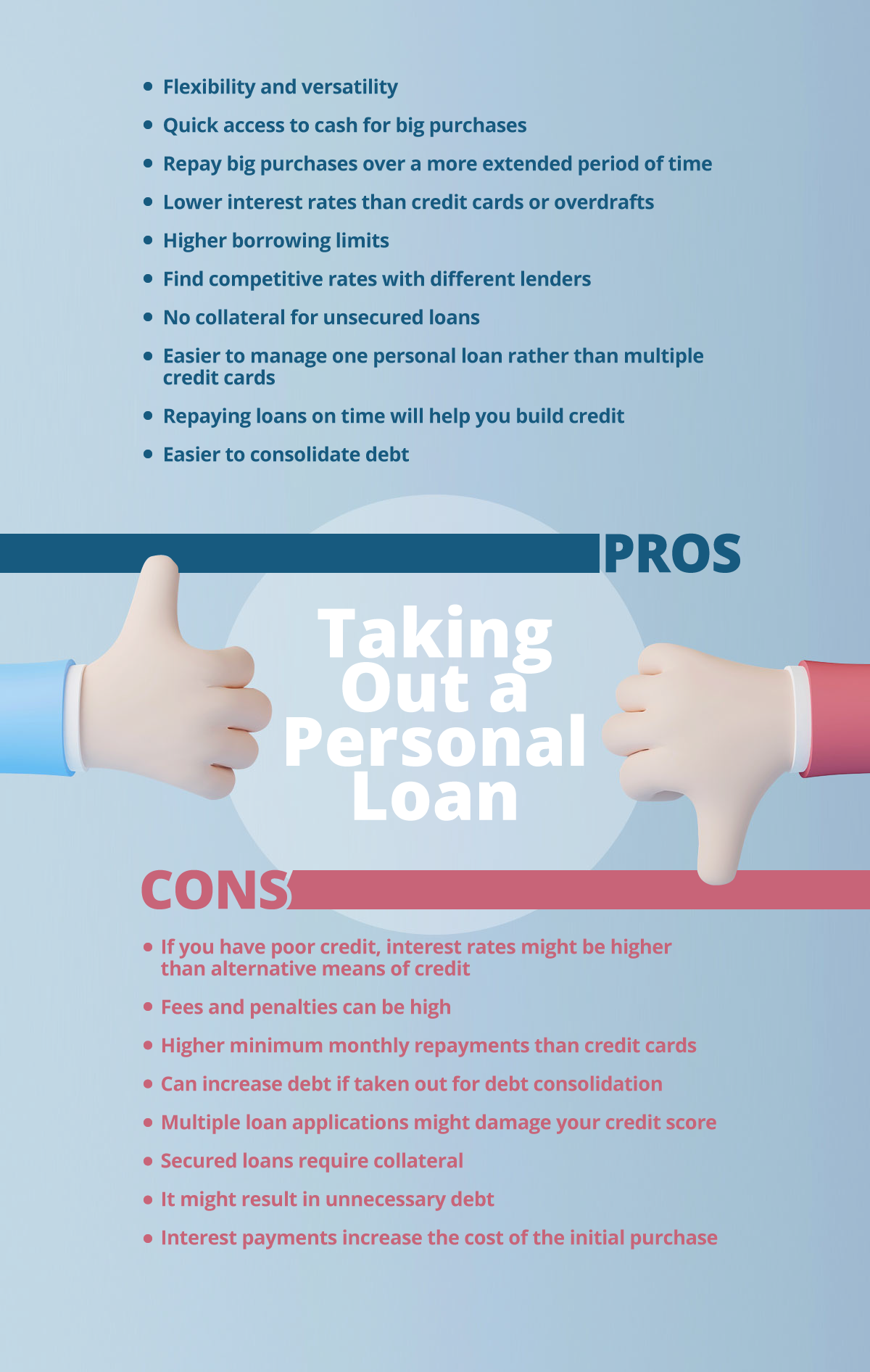

Personal loans aren't for everyone. Make sure that you're making a sound financial decision before taking out the loan. Here are the pros and cons.

Pros

- Flexibility and versatility

- Quick access to cash for big purchases

- Repay big purchases over a more extended period of time

- Lower interest rates than credit cards or overdrafts

- Higher borrowing limits

- Find competitive rates with different lenders

- No collateral for unsecured loans

- Easier to manage one personal loan rather than multiple credit cards

- Easier to consolidate debt

- Repaying loans on time will help you build credit

Cons

- If you have poor credit, interest rates might be higher than alternative means of credit

- Fees and penalties can be high

- Higher minimum monthly repayments than credit cards

- Can increase debt if taken out for debt consolidation

- Multiple loan applications might damage your credit score

- Secured loans require collateral

- It might result in unnecessary debt

- Interest payments increase the cost of the initial purchase

How Do I Choose the Best Personal Loan?

Whether you need a personal loan depends on your financial circumstances. You should ask yourself several questions.

- What is the loan for?

- Can you afford the monthly repayments?

If you have extra discretionary income each month, getting a personal loan might suit you. It'll enable you to make a big purchase and spread the cost over a period that suits you.

However, if you already struggle to make your necessary payments—your mortgage or rent, food, and utility bills—then taking out a personal loan might worsen your financial situation. You don't want to risk spiralling into debt.

To choose the best personal loan, take stock of your situation. No one loan is perfect for everyone. A secured loan might get you better rates if you're comfortable doing so. However, if you want greater spending flexibility, you might prefer an unsecured loan. Remember to look at the comparison rate and interest to get the best possible deal.

Key Takeaways

Personal loans are a form of credit that you can spend however you like. They're typically used for lower-value assets than property, like cars, and are an excellent solution to forking out significant payments. Yet, like any financial product, you need to ensure that your loan suits your situation.

Shopping around can help you avoid any bad deals, and speaking to a finance broker might save you significant sums of money in the future.

Conclusion

Personal loans offer a versatile and often necessary financial tool for many Australians. Whether you're consolidating debt, financing a major purchase, or handling unexpected expenses, understanding the various aspects of personal loans can empower you to make the best decisions for your financial health. Remember to carefully assess your needs, research your options, and consider professional advice to navigate the world of personal loans effectively.

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

Comments (5)