Share this

Tradies Finance | The Ultimate Guide [2024 UPDATED]

by Piera Rossi on Nov 16, 2021 3:21:23 PM

Finance for Tradies | From Getting your First Car Loan to Offering Finance to Your Customers

For tradies, having the right tools, equipment, and vehicle is essential to success. Financing can make acquiring these necessities easier, but understanding the best loan options can be challenging. This evergreen guide provides detailed insights into financing options for tradies, ensuring you make informed decisions to enhance your business and lifestyle.

Don't have time to read this now?

Download the Tradies Finance | The Ultimate Guide

Table of Contents

1. Car loans for tradies

1.1 Car loans for tradies employed by a business (PAYG): Consumer Car Loan.

1.2 Car loans for tradies on ABN: Commercial Car Loan

1.3 Low Doc Loans

2. Equipment loans

3. Truck loans

4. Business cash flow loans

5. Personal loans

6. Tradie advice; how to increase your chances of getting your loan approved

7. Ausloans loan process

8. FAQs

9. Finance solutions to grow your business; Getting finance for your customers

1. Car Loans for Tradies

A car loan for tradespeople is basically just a loan for a motor vehicle that will be used a minimum of 51% of the time for work.

There are two types of car loans for tradies; Consumer Car Loan and Commercial Car Loan. The right loan for you will depend on how you're employed. Below we explain each of them.

1.1. Car Loans for Tradies Employed by a Business (PAYG): Consumer Car Loan

If you are employed by a company and therefore every time you receive your wages you also get a payslip, you should apply for a Consumer Car Loan. This is a standard car loan, available with no deposit and usually up to 7 years term.

Secured vs Unsecured Car Loans

Secured Loan: Consumer Car Loans are always secured, which means the lender uses the car as a security against the loan. If you don't make the agreed repayments the lender can take possession of the car.

Unsecured Loan: This is a personal loan which means you can borrow money for the purpose you choose. As it is riskier for lenders because no security item is provided by the borrower, it generally comes with a higher interest rate than secured loans. It can be an excellent option if you are looking to finance not only your working vehicle, but also your trailer, toolboxes, tools and more.

Benefits of a Consumer Car Loan

- No deposit loan available. You can purchase a new or used car without having to pay any money upfront. In fact, if you wish, you can borrow 100% of the car’s purchase price.

- You don’t have the obligation of using your car for work. You can use it as you want!

- By making your car loan repayments on time you can contribute to a stronger credit score. So, if you are planning to get that brand new Ute or apply for a mortgage in the future, you will need a strong credit rating to show you have a good history to get approval.

|

|

Do I need insurance for my car?

Yes, secured car loans always need insurance.

1.2 Car Loans for Tradies on ABN: Commercial Car Loan

If you are a tradie working as a contractor, either as an individual (sole trader) or in your own company, you must have an ABN (Australian Business Number) and therefore you are eligible for a commercial car loan.

A commercial car loan is more flexible than a consumer loan and requires less documentation, so it can be a great option for tradies working on ABN. A Commercial Car Loan is a loan for a motor vehicle that will be used at least 51% of the time for business.

Secured vs Unsecured Car Loan

Secured Commercial Car Loan: The lender uses the car as a security, which means that if you don't make the agreed repayments the lender can take possession of the car.

Unsecured Loan: Unsecured loans are basically personal loans for businesses. It is riskier for lenders because no security item is provided by the borrower so it generally comes with a higher interest rate than secured loans, but it can be an option if you are looking to finance not only your working vehicle, but other accessories, or getting cash flow for your business.

Do I need insurance for my car? Yes, secured car loans always need insurance.

Benefits of a Commercial Car Loan

- Low Doc Loans options: A low doc car loan is a finance option only available for ABN holders. A low doc loan requires less documentation, and it is a great option if you don't have your taxes in order or enough money on paper to show you can afford the loan. We explain this further below.

- Deposit Loan Available: You can purchase a new or used car without having to pay any money upfront. In fact, if you wish, you can borrow 100% of the car’s purchase price.

- Tax Benefits: You might be eligible to claim certain depreciation, interests, accessories for the car, etc. We recommend you talk to your accountant regarding this.

- Commercial Car Loan also contributes to a stronger credit score. So, if you are planning to get that brand new Ute of your dreams or apply for a mortgage in the future, you will need a strong credit rating to show you have a good history to get approval.

Low Doc Loan

One of the main benefits of applying for a commercial car loan is that you can apply to a Low Doc Loan. Lenders allow ABN holders to apply for a Low Doc Loan if they meet certain criteria, which means that they'll give you a loan just based on your credit history and how long your ABN has been active. The good news about a Low Doc Loan is that you don't need any financials, and we can get you approved!

Documents you need for a Low Doc Loan

- Drivers License details

- ABN number

- On occasion, bank statements - Not a must

The lender uses the car as a security, which means that if you don't make the agreed repayments the lender can take possession of the car.

Types of Low Doc Loans

Chattel Mortgage:

It is a standard commercial car loan. Generally, Chattel Mortgage loans are over five to seven-year terms, and you have access to a balloon payment* which means you pay a portion of the loan at the very end in a lump sum. You also have the option to pay the loan early, however, this can include extra fees from your lender (we recommend you enquire about this to your broker).

Novated Lease:

A novated lease is a deal between you, your employer, and the lender. The amount of the loan is deducted from your payments which means you pay for it with your pre-tax earnings. You can include a balloon payment at the end, and you get ownership only when the loan term finishes and the residual is also paid.

*What is a balloon payment?

|

HOT TIP! What to do when paying a balloon payment |

2. Equipment Loans

An Equipment Loan is a loan for a piece of equipment and is only available for tangible goods. Equipment Loans usually offer low-interest rates and are secured against the asset, which means if you don’t make the repayments, the lender can repossess the item.

Frequently Asked Questions About Equipment Loans

- Some of the goods you can finance with an Equipment Loan:

Yellow goods such as a bulldozer, earth moving equipment, quarrying equipment, forklift, tractors, etc. If the item you want to finance is critical to the business and its income-producing, lenders are more interested in lending the money and you have more chances of getting approved. - Can I finance my set of tools with an equipment loan?

No, lenders would only finance through an equipment loan, bigger individual items that have a value generally over $8,000. If you would like a loan to finance your whole set of tools; from your screwdrivers and nail guns to your drop saw and grinder, you should apply for an unsecured personal loan or an unsecured commercial loan, that gives you the freedom to use the amount financed for anything you want or need. - Can I get a Low Doc Equipment Loan?

It depends on the value of the equipment you’re financing. Equipment over $50,000 usually requires more documents than the standard documents required in a Low Doc Loan. - Do I need insurance on my equipment?

Yes, always. If you would like to get insurance, speak with your assigned broker.

3. Commercial Truck Loan

A truck loan, as the name indicates is a loan to finance specifically a heavy vehicle. A truck loan is only secured, which means the truck is secured against the loan in case you don’t make your repayments and are usually up to 7 years term.

Limits on truck weight

Lenders have different limits in terms of maximum size and weight they can finance. Most commonly, every lender would finance a truck that's under 4.5 tons, but options get more limited when the truck is heavier than that. This is where you can benefit from a panel of 40+ Lenders like Ausloans, which has lenders that finance trucks over 4.5 tons.

| HOT TIP! Inform your broker about the type of truck you want If you are looking to finance a truck, let your broker know upfront about the exact type of truck you’re looking to finance so, it can submit your application to the correct lender. When it comes to truck loans and businesses, lenders want to know the inside and out about what your business is. Be mindful in answering your broker the following questions to increase chances of approval; why do you want a truck? and how the truck you're buying is going to produce your business more income? |

Types of Trucks Loans

Chattel Mortgage

It is a standard commercial truck loan. It can be no-deposit and you have access to a balloon payment.

Frequently Asked Questions About Truck Loans

- Do I need insurance?

Yes, always. If you would like to get insurance, speak with your assigned broker. - Can I get a Low Doc truck finance?

It depends on how much are you borrowing for the truck. Trucks over $50,000 usually require more documents than the standard documents required in a Low Doc Loan.

4. Business Cash Flow Loan

A business Cash Flow Loan is basically an unsecured personal loan for businesses. Business cash flow loans are mainly unsecured and tend to have high-interest rates. They run over a term from 12 to 24 months and are designed to quickly give your business the benefit of immediate cash in order to gain more businesses (e.g. stock, material, or wages for a new job on contract, etc.).

Benefits of a Business Cash Flow Loan

- Low Doc Options: You will only need an ABN and bank statements that show you're earning enough income.

- It can give your business the stimulus to gain more business.

5. Personal Loan

Personal Loans are better for all the things that equipment or car loans won't finance. It is riskier for lenders because no security item is provided by the borrower so it generally comes with a higher interest rate than secured loans, but it can be an option if you are looking to finance not only your working vehicle but other accessories. Ask your assigned broker for more information about this.

6. Tradie Advice | How to increase your chances of getting your loan approved

Advice for Tradies on PAYG

If you are PAYG which means you work for someone, you’re still doing your apprentice and it is your first time borrowing, the recommendation is to start small where you're comfortable by getting a smaller loan of no more than 15,000 to 20,000. This will help you build your credit rating and enjoy the benefits of it in the future.

We recommend you put any extra money on top of the loan, to show that you can pay ahead. When you finish your apprenticeship or start your new business, you can upgrade and buy your new car.

Advice for Tradies on ABN

- As soon as you start earning more than $75K a year, register for GST. This way, lenders understand you earn more than $75K a year and you can substantially increase your chances of getting approved for bigger amounts. If you are not registered for GST, Lenders understand your business makes less than $75K hindering your lending options.

- Keep your personal and your business account separate. This will make it easier to justify your business income and spending to a lender and will help to get faster approval.

- Keep good banking conduct. Make sure you always have a minimum positive balance in your bank account, which basically means; don’t go below zero. It can be hard, but a good practice is to always keep a buffer in your account. This means your zero is no longer zero, it is, for example, $1,000. This way your account maintains a positive balance, even when a sudden unfavourable situation comes up like a client paying you late or unexpectedly buying more materials than planned.

- Contribute with a deposit: Although Ausloans Car Loans don’t require a deposit, contributing upfront with a percent of the total amount can make a difference in getting approved faster and easier.

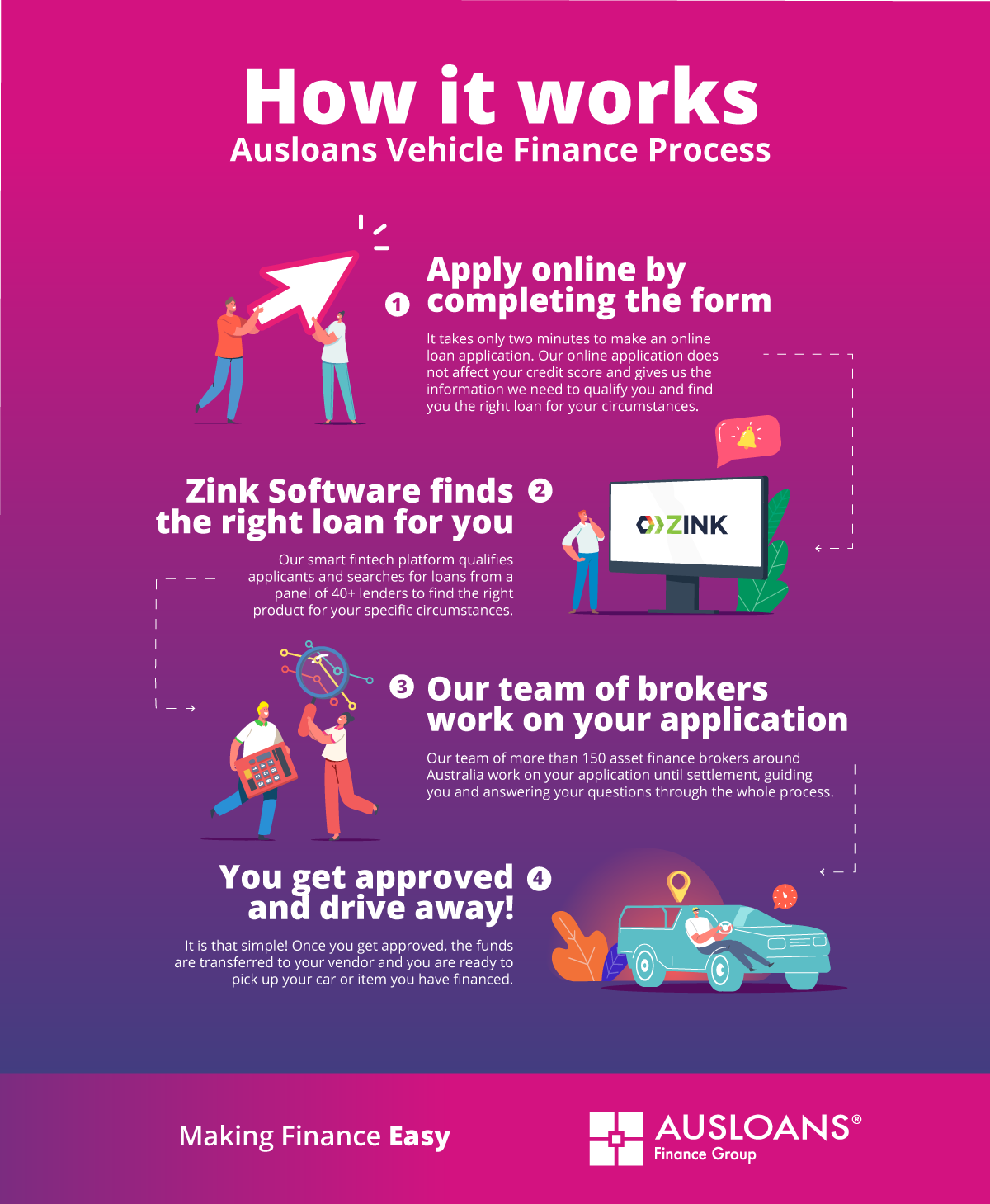

7. Ausloans Loan Process

Applying for a loan with Ausloans is fast and easy. Simply follow these steps:

8. FAQs

- How long do I need to have an ABN running to qualify for a low doc car loan?

You can qualify for a Low Doc Loan with an ABN as recent as one day old if you have previous experience in the same industry as your business. If you are starting a business in a whole new area, you will need an ABN running for at least six months.

- Does the vehicle being purchased via a low doc car loan have to be used for business?

Yes, the vehicle must be used predominately for business use. 'Predominately' is considered greater than 50% of businesses related use.

- How long does a low doc car loan approval take?

The entire process, from completing our application form to approval, and your chosen seller receiving funds in their bank account, can be done as quickly as only a few hours. However, consider actual turnaround times will vary significantly depending on many factors; lender turnaround times, contactability of the applicant, the strength of the applicant's profile, gathering the required documents, additional information required by the lender, etc.

- What documents do you need for a Low Doc Car Loan?

- Driver License details

- ABN number

- On occasion, bank statements - not a must. - Can I get my car loan approved if I have bad credit?

Yes, you can get approved for a bad credit car loan. At Ausloans we believe in assessing your circumstances and finding a solution that best suits you.

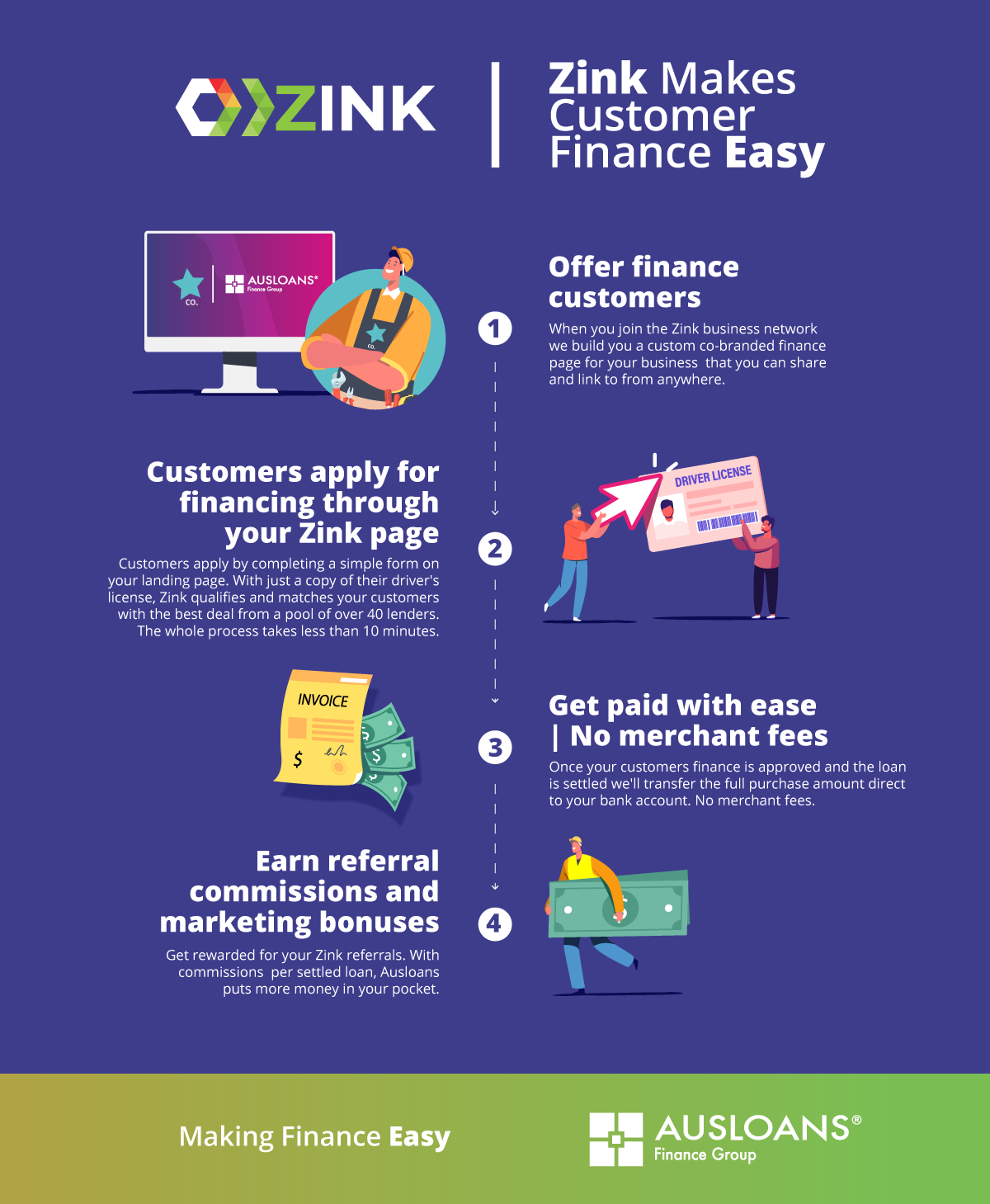

9. Finance solutions to grow your business | Offer finance to your customers and gain more businesses

Are your customers struggling to pay?

How many of them have said to you “sorry too expensive, I am a bit short at the moment”? What would happen if your quote would not only have the full price of the job but also a weekly instalment option? So suddenly your job doesn’t cost $10,000, and it is only $100 per week. What if you would get those $10,000 deposited in your account as soon as your client gets approved by the lender?

How does It work?

At Ausloans we make customer finance easy for trades businesses and sole traders!

Don't have time to read this now?

Download the Tradies Finance | The Ultimate Guide

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

No Comments Yet

Let us know what you think