Share this

Car Loan Refinancing in Australia: Navigating Your Options for Financial Flexibility

by Larissa F. Gasperi on Nov 20, 2023 2:58:45 PM

When it comes to managing your personal finances, the terms of your car loan can make a significant difference in your monthly budget and overall interest payments. Refinancing your vehicle finance can be a strategic move to align with your financial goals. In this comprehensive guide, we'll dive deep into the intricacies of refinancing your car loan, helping you understand when it’s a strategic move, the advantages it may bring, and the potential downsides. when to consider

Understanding Car Loan Refinancing

Refinancing a car loan involves replacing your current car finance agreement with a new one, typically with a different lender. This new agreement often comes with a lower interest rate, altered loan terms, or both, which can potentially lead to lower monthly payments or a shorter loan duration.

When to Consider Refinancing Your Car Loan

Refinancing might be an excellent option to consider if:

- Interest Rates Have Dropped: If the market rates have fallen since you took out your original car loan, refinancing could secure you a more favourable rate, reducing the overall cost of your loan.

- Your Credit Score Has Improved: A better credit score can unlock lower interest rates because lenders see you as less of a risk.

- You Need Lower Periodical Payments: Extending your loan term can reduce your monthly payments, giving you more breathing room in your budget.

- You Seek to Pay Off Your Loan Sooner: Shortening your loan term can increase your periodical payments but decrease the total interest you pay overtime.

The Benefits of Refinancing Your Car Loan

- Reduced Interest Rates: Perhaps the most compelling reason to refinance is to take advantage of lower interest rates, which can save you money over the life of your loan.

- Flexible Loan Terms: Refinancing can adjust your loan term to better suit your current financial situation, whether that means shortening it to pay off the loan quicker or extending it to lower monthly payments.

- Cash-Out Option: Some refinancing options allow you to tap into the equity of your vehicle, giving you access to cash that can be used for other expenses.

The Drawbacks of Car Loan Refinancing

- Potential Fees: Refinancing might come with fees such as application fees, origination fees, or early exit fees from your current loan that can offset the financial benefits of a lower rate.

- Extended Debt Period: Lengthening your loan term can lower your periodical payments but can also mean you'll pay more in interest over the life of the loan.

- Upside-Down Risk: If your car depreciates faster than you pay off your loan, you could end up owing more than the car's worth.

How to Refinance Your Car Loan

To refinance your auto loan, you’ll want to:

- Check Your Credit Score: Understanding your credit health is pivotal. A higher credit score often leads to more favourable interest rates. It's the foundation of what terms you might be offered, so it’s worth taking steps to improve it if necessary.

- Assess Your Current Loan: Take a close look at your existing loan's details — the interest rate, how much you have left to pay, and your current interest costs. This will be the baseline for comparing any new loan offers.

- Explore Refinancing Options with Ausloans: Instead of navigating the refinancing labyrinth alone, leverage the power of Ausloans' Zink platform. It provides a comprehensive overview of rates from over 40 lenders, empowering our brokers with the information they need to find the best terms that fit your individual financial circumstances.

- Get a Cost-Benefit Analysis: Before making a decision, it's crucial to understand all associated costs of refinancing. Our brokers will provide a detailed breakdown, ensuring that any potential savings from refinancing are not offset by fees and charges.

- Pre-Approval Process: When you're ready, the next step is to apply. With Ausloans, a broker will be in touch to guide you through the options you've been pre-approved for, based on your circumstances and needs. This step confirms the feasibility of the refinancing terms before proceeding to final approval.

- Finalise Your Loan: After pre-approval, your broker will assist you in finalising the loan. You'll need to have all your documentation ready — proof of income, vehicle information, and identification — to settle your new refinanced loan smoothly.

Is It Worth It to Refinance?

Refinancing isn’t for everyone. If you’re comfortable with your car loan repayments or your financial situation hasn’t changed since taking out the loan, it might not be worth the hassle. However, if you think you might reduce your interest rate by as little as 0.5% or even 0.25%, you could make incredible savings.

Say you have a remaining car loan balance of $30,000 with an interest rate of 6.49% and five years remaining. Your overall interest repayments would be $6,920 with monthly payments of $782. However, under the same circumstances, if you reduce your interest rate to 6%, your total interest would equal $6,380. You would pay $773 a month. The extra $11 a month free could significantly affect your long and short-term expenses.

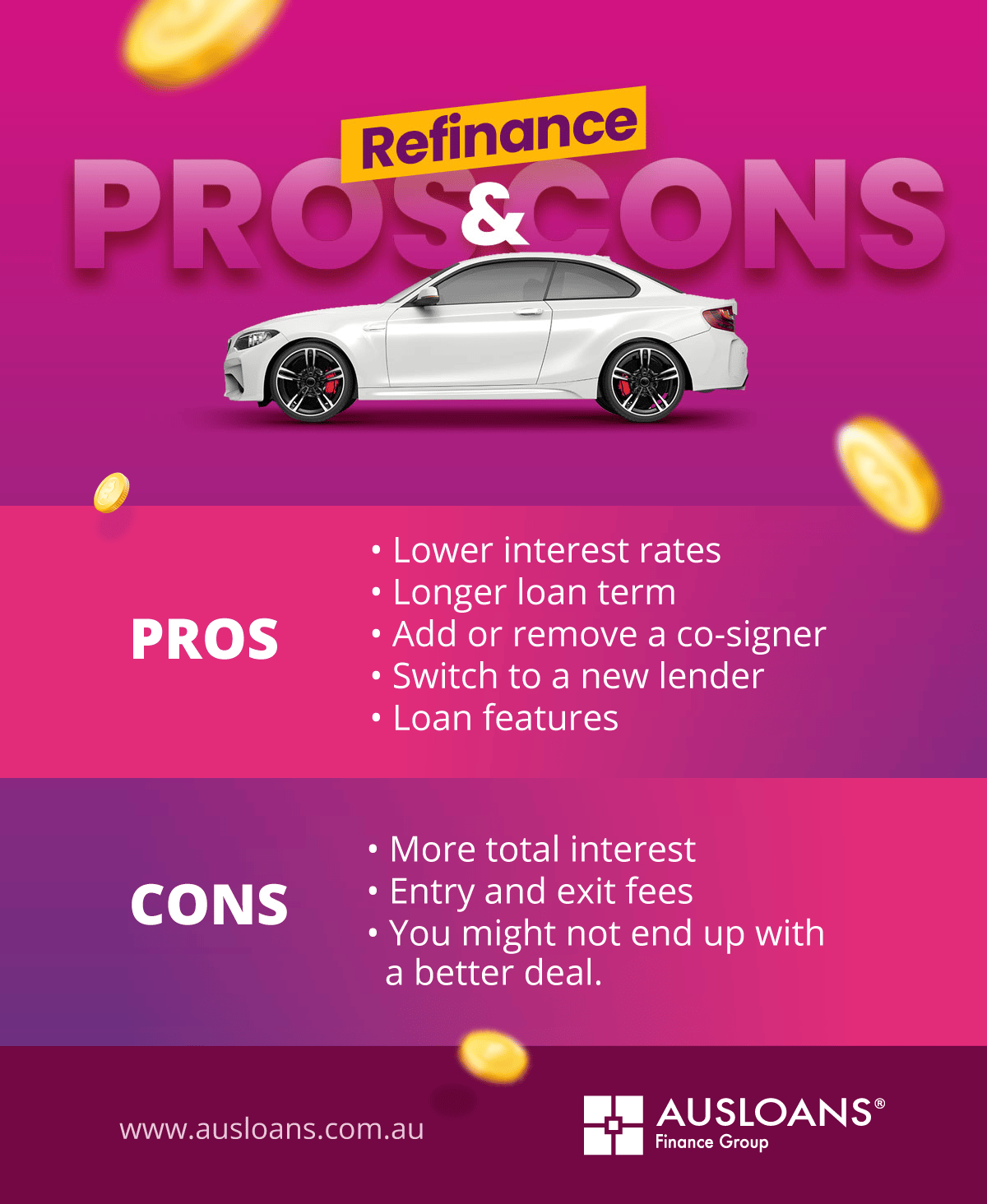

Pros and Cons of Refinancing Your Car Loan

Benefits of Refinancing Your Loan

- Lower Interest Rates: The most common reason people refinance is to reach lower interest rates. Lowering your interest repayments can help you make savings in the short term and reduce the overall amount you pay towards your loan.

- Longer Loan Term: If you’re struggling to meet your monthly repayments, you can reduce them by extending your loan term. Each repayment is lower because the lender divides the principal by more monthly repayments.

- Add or Remove a Co-signer: You might want to add or remove a co-signer to your loan to get a better interest rate.

- Switch to a New Lender: If your current lender is difficult, you might improve your circumstances by going to a new lender.

- Loan Features: You can switch to a fixed, variable, or interest-only car loan.

Drawbacks of Refinancing Your Loan

- More Total Interest: If you negotiate a longer loan term to reduce your monthly repayments, you might pay more interest overall on your car loan.

- Entry and Exit Fees: If you switch lenders, you might have to pay new loan application fees and exit fees for leaving your old loan.

- You Might Not End Up with a Better Deal: If you don’t set yourself a clear goal of what you want from refinancing, you might not end up with a better deal. Speak to a finance broker to ensure you get a good deal on your next loan.

When Should I Refinance?

Depending on your lender and car loan terms, it might not make sense to refinance your car loan early. For example, if you have exit fees, you may lose more money than you save. So, when does it make sense to refinance your car loan?

- If You Have a Bad Loan Deal: Car owners who get financing through a dealership often end up with high-interest rates and additional fees. The sooner you refinance to a lender with lower rates, the better.

- Your Credit Score Has Improved: After a few months or a year of making timely repayments on your car loan, your credit score should jump up a few points. Therefore, you’ll have better borrowing power.

FAQs in Car Loan Refinancing

- What does it mean to refinance a car loan?

Refinancing a car loan means you replace your current car loan with a new one, usually with different terms such as a lower interest rate or different loan duration. This can lead to more favourable repayment conditions for your financial situation. - How does refinancing save me money on my car loan?

Refinancing can save you money primarily by securing a lower interest rate, which means you'll pay less over the life of your loan. It can also adjust your monthly payments to fit your budget better. - Can I refinance my car loan with bad credit?

Yes, you can refinance with bad credit, but the terms might not be as favorable as they would be with a higher credit score. It's essential to improve your credit score before refinancing to get the best rates. - Will refinancing my car loan affect my credit score?

Refinancing your car loan will require a hard credit inquiry, which might slightly lower your credit score temporarily. However, if refinancing leads to more manageable payments, it could positively affect your credit score in the long run. - How often can I refinance my car loan?

Technically, you can refinance your car loan as often as you like, but it’s important to consider the costs associated with refinancing, such as fees and the potential impact on your credit score. - Are there any fees involved in refinancing a car loan?

Yes, there may be fees involved in refinancing, such as application fees, origination fees, and possibly penalties for paying off your old loan early. It's vital to calculate these costs to see if refinancing is worthwhile. - How long does it take to refinance a car loan?

The refinancing process can take anywhere from a few days to a few weeks, depending on various factors, including the lender's efficiency, the completeness of your application, and how quickly you submit the required documents. - What documents do I need to refinance my car loan?

You'll typically need proof of income, proof of residence, government-issued identification, details about your vehicle, and information about your current loan. - Can I refinance my car loan to remove a cosigner?

Yes, if your credit and income are sufficient, you can refinance your car loan to remove a cosigner from the original loan agreement. - Should I refinance my car loan through my current lender or a new one?

It's beneficial to shop around and compare offers from both your current lender and new lenders to find the best refinancing deal. - How do I know if it's the right time to refinance my car loan?

The right time to refinance is when you can secure a lower interest rate, your credit score has improved, market conditions are favourable, or your financial situation has changed, requiring more manageable payment terms.

Requirements to Refinance

If you wish to refinance your car loan, you will need to meet the following criteria:

- Have evidence of a good track record of paying your car loan repayments on time.

- Be at least six months into your current loan (most lenders will not allow you to refinance any earlier).

- Have a good credit score—or at least a more substantial score than you had initially.

- You need to be an Australian citizen or permanent resident.

What Documents Do I Need?

When you submit your car loan refinancing application, you’ll need to share some documents with your new or existing lender. If you stay with the same lender, they may already have some of the information on file. A new lender will be like starting all over again; you’ll need to submit all your loan documents.

Gathering everything before starting the application will ensure everything goes more smoothly. You might need to share:

- A copy of your driver’s licence

- Vehicle registration

- Proof of car insurance

- Proof of income and other financial documents

- Proof of residence

- Vehicle identification number (VIN)

Where to Refinance - Car Loan Aggregator

Going directly to the lender might get you a good deal if you have built up a relationship with them. However, if you’re opting to refinance with a new lender, a car loan aggregator will help you reach better terms. With a range of lenders on our panel, we’ll help you put together a robust application and refinance your car loan with the best deal for your situation.

Conclusion

Refinancing your car loan in Australia can be a wise financial move under the right circumstances. It offers the potential for lower interest rates, reduced repayments, and more suitable loan terms. However, it’s crucial to weigh the benefits against the potential drawbacks, such as fees or extended loan terms. By carefully considering your options and choosing the right time to refinance, you can ensure that your car loan continues to be a manageable part of your financial portfolio.

Are you considering refinancing your car loan? Contact Ausloans to explore your loan options. We have over 40 lenders, fast and online application and competitive refinancing options that could save you money and align with your financial objectives.

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

No Comments Yet

Let us know what you think