Share this

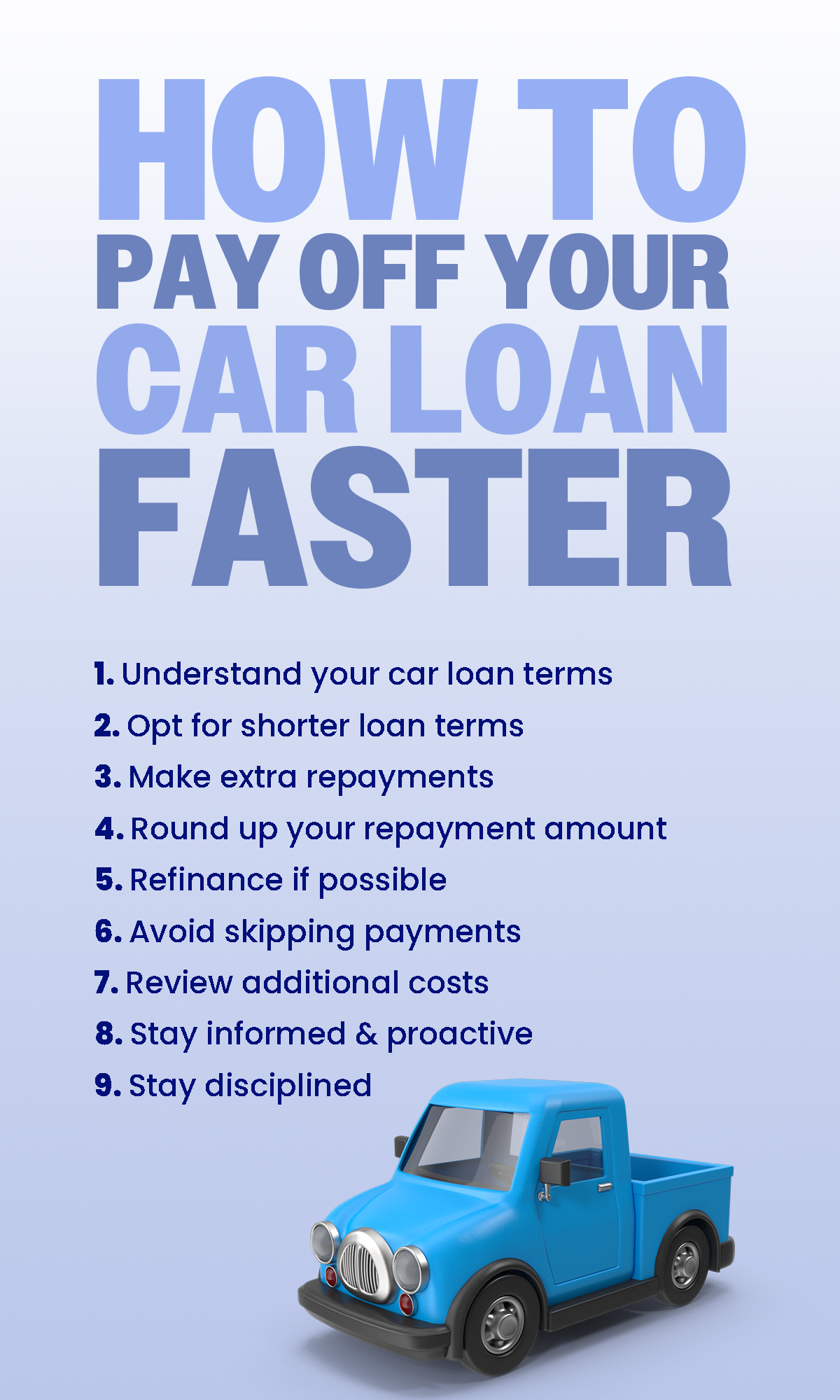

Here's How to Pay Off Your Car Loan Faster

by Larissa F. Gasperi on Sep 15, 2023 11:12:29 AM

In Australia, the car market is vibrant and dynamic, leading many to opt for car loans. Securing that dream vehicle has never been more accessible with a variety of financing options available. But once you have that loan, how do you manage it effectively? As a premier financial brokerage in Australia that specialises in car loans, we're sharing key strategies to help you navigate your car loan journey more efficiently.

So how can you pay off your car loan faster? Read on!

1. Understand Your Car Loan Terms

It's vital to immerse yourself in your auto loan terms. Knowledge about specific details such as interest rates, loan duration, and any early repayment penalties can set the foundation for a robust repayment plan.

2. Opt for Shorter Loan Terms

While extended tenures can seem alluring due to the prospect of smaller weekly payments, they might end up costing more in interest over the term. Choosing a shorter car finance term, if feasible for your budget, could save a notable amount in the long haul.

3. Make Extra Repayments

One of the most straightforward strategies to speed up your car loan payoff is by making extra repayments when possible. These additional payments reduce both the principal loan amount and cumulative interest. Consider allocating funds from bonuses, tax returns, inheritance, or other unexpected income for this purpose. However, it's important to note that not all lenders are accommodating towards extra repayments. Some might charge fees or have specific policies in place. Always consult with your lender before making alterations to your repayment structure.

4. Round Up Your Repayment Amount

Looking for an easy hack? Simply round up your repayment sum. For instance, if your obligation stands at $897, consider rounding it up to $900 or even $1,000. Alternatively, consistently adding an extra $30 or $60 can make a considerable difference. This approach ensures you're consistently paying above the bare minimum, effectively reducing both interest and the loan's duration. Again, bear in mind that every lender operates differently. It's crucial to check with them first to ensure you can freely adjust your payment amounts, and if so, check if it will end in incurring additional charges.

5. Refinance If Possible

It's important to periodically reevaluate your car finance conditions. If you stumble upon a lender presenting a more attractive interest rate than your existing one, think about refinancing your car loan. This could either diminish your weekly outlays or trim your loan tenure.

6. Avoid Skipping Payments

While some lenders might offer an occasional 'skip-a-payment' privilege, it's wise to use this sparingly. Postponing payments typically lengthens your loan duration and can lead to accrued interest.

7. Review Additional Costs

Ensure you're informed about all fees and costs linked with your car loan, from administration charges to associated insurances. Sometimes, addressing these separately can shave off a significant chunk from the overall interest on the car loan.

8. Stay Informed & Proactive

Continually updating yourself with the latest trends and offerings in the car finance sector is vital. Engage with us, your trusted financial brokerage, for up-to-date insights and advice tailored to your financial landscape.

9. Stay Disciplined

A consistent, disciplined approach to payments and budget management is key. Sidestep unnecessary upgrades or add-ons and keep your eyes on the primary goal: ridding yourself of car loan obligations ahead of schedule.

Conclusion

Efficiently handling your car loan involves a mix of sound strategies, a proactive mindset, and maintaining open communication with your lender. At Ausloans, we're passionate about guiding you through the car finance maze, ensuring each turn you take aligns with your best interests. For all matters car loans, from repayment insights to finding the best packages in Australia, our expert team awaits your call. Get in touch today and let's drive towards a more financially free tomorrow!

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

No Comments Yet

Let us know what you think