Share this

How to Leverage the Gov $150,000 Write-Off

by Piera Rossi on Jun 2, 2022 5:22:09 PM

The past few years have seen many businesses across Australia and the rest of the world struggle. The economic impact of the Covid-19 pandemic has hit business owners. While some are returning to their normal, day to day functionality, others are still struggling to manage their finances in a post-pandemic world.

The Australian government has introduced various schemes to help businesses over the years—particularly in times of economic downturn. More recently, the government has made amendments to the instant asset write-off scheme. In this article, we will discuss what they are, how they work, and how you can make the most of them.

What Is an Instant Asset Write-off?

The instant asset write-off scheme is to help eligible businesses claim immediate tax relief for the total cost of depreciating assets. Tax deductions (particularly in workplace settings) can help companies to reduce their taxable income—in some cases, this can make a massive difference to the business's finances.

The instant asset write-off scheme enables businesses to write off the total cost of eligible assets as long as the purchase is less than $150,000. During the pandemic, the government announced that it would remove this threshold temporarily.

For instance, say you had a company car that depreciated significantly within the same year you purchased it. You could claim an instant tax deduction for the asset and receive 100% of the cost of the investment back on your tax bill.

How Does the Instant Asset Write-off Work?

The instant asset write-off is pretty simple. If you are a business owner purchasing or upgrading any business equipment, there is always a risk that it is not worth the investment.

Small businesses, especially, must take great care to ensure every investment is profitable. However, with the instant asset write-off scheme, small companies can find some relief should the asset depreciate. Here is how it works:

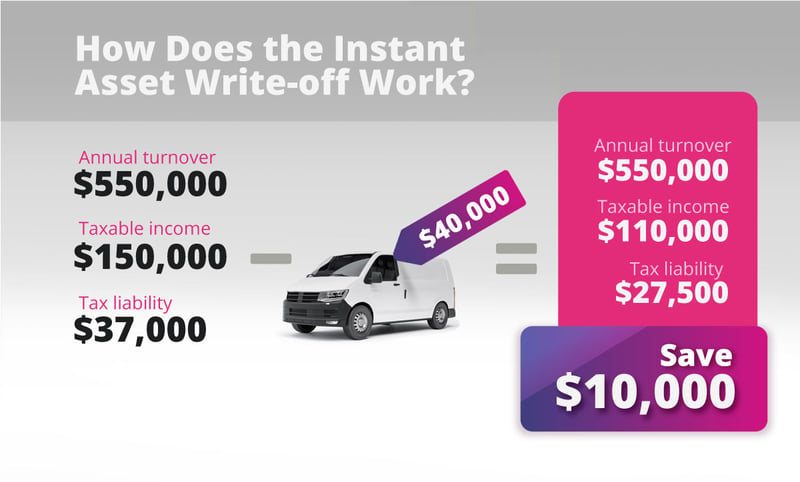

- Let's say you run a small company with an annual turnover of $550,000 and a taxable income of $150,000.

- With a turnover of less than $25 million, you must pay the Australian company tax rate of 25%. Your total tax liability is $37,000.

- You purchase a company car worth $40,000. You can deduct its total value from your net taxable income during the same financial year.

- Therefore, you reduce your total taxable income to $110,000.

- Your new tax bill is $27,500, saving you $10,000. However, you must meet the eligibility criteria for the government's instant asset write-off scheme to receive these benefits.

You don't need to submit any sort of application to receive the tax benefits of the instant asset write-off scheme; simply add the tax deduction to your tax return for that financial year.

Why Are Tax Deductions Good?

Any business owner, investor, or Australian completing a tax return might consider whether they can deduct eligible expenses from their taxable income.

All businesses can deduct depreciating assets from their taxable income over the years. With the help of a tax adviser, you can calculate the depreciation of your assets and deduct a sum each year. However, with the instant asset write-off, businesses are able to fast-track the deductions and claim the total depreciation cost in one go.

If you can deduct the cost of a car (say, around $40,000) or a car loan plus interest from a taxable income of $100,000, you would pay far less tax. With a new taxable income of $60,000, you would be in a lower tax bracket, paying only 32.5%, not 37%. Such differences can make a significant impact on any business owner or investor.

Of course, not all assets are eligible for tax deductions or the instant asset write-off.

Who Is Eligible for the Instant Asset Write-off?

The instant asset write-off is available for all businesses in Australia (including sole traders, partnerships, companies, and trusts) with a total annual income under $5 billion. Also, businesses with an aggregated turnover of $500 million or less can also claim an instant asset write-off.

You must have purchased, used or installed the asset for business purposes within the same financial year as you claim. For instance, if you buy new machinery on the 20th of June but don't use it until September, you will have to claim it in the following tax year. The write-off must be essential for the business—for instance, it can't be any old item that you rarely use.

Similarly, if you purchase an asset used for both business and personal reasons, you can only deduct a percentage of the value used for business.

If we go back to our car example—if you use it for personal trips on the weekends and business use during the weekdays, you can only claim 71.43% as a tax deduction. If the car is worth $40,000, you can only deduct $28,572 of the asset value from your taxable income.

In addition, your business must have a registered ABN and actively operate to qualify for the instant asset write-off. You can claim for multiple items as long as no individual asset exceeds the threshold of $150,000. However, the eligibility criteria may change over time, so make sure you keep an eye on the ATO's guidelines to stay updated.

Since the pandemic, the government has increased the threshold for assets from $30,000 to $150,000. Similarly, qualifying businesses can now have an annual turnover of $500 million rather than the original $50,000. These changes are set until 2023—however, the ATO could revise the eligibility criteria at any time.

What About Partnerships?

Partnerships are allowed to make claims under the instant asset write-off, but the purchases are considered owned by the partnership as a whole, not individual partners.

If a partner buys an asset in their own name, such as a vehicle, the purchase is not eligible for the write-off as part of the partnership. If the partner does not qualify as a small business taxpayer in their own right, they cannot use the write off for the car.

Are Second Hand Assets Eligible?

Yes, both new and second-hand assets qualify for the instant asset write off scheme. As long as your items meet the above criteria, it doesn't matter whether they are brand new or not. Therefore, you could claim tax deductions for used cars as well as new ones.

Examples of qualifying assets include:

- Vehicles and company cars

- Plant equipment

- Machinery

- Office equipment and IT hardware, including laptops, printers, tablets, and scanners

- Tools, such as lawnmowers, hammers, axes, etc.

- Furniture, such as lighting and fittings

- Air conditioners

Check with the ATO about whether your assets meet the eligibility criteria for the instant write-off.

What Type of Purchases Should I Consider Making?

Making large purchases purely for the purposes of reducing your taxable income isn't a good idea. If you plan on making a significant investment, speak to your accountant or tax professional first to understand the benefits and impacts on your short term cash flow. Of course, many larger purchases can be made with loans that may ease the short term financial burden.

If you decide to use the instant asset write-off, you should only purchase items that your business needs. For instance, if you need a vehicle to deliver goods or expand your business operations, it's a good idea to use the instant asset write-off plan.

What Happens if I Make a Purchase That Is Greater Than the Write-off Amount?

The instant asset write-off threshold is $150,000, and it applies to the total cost of the asset, not just a taxable portion. Therefore, if you have an item over $150,000, you cannot claim an instant asset write-off. However, you can claim gradual depreciation deductions each tax year.

How to Claim the Instant Asset Write-off

If you buy an eligible asset under the $150,000 threshold, you can claim a tax deduction for it in the same tax year. Similarly, you can claim a deduction for multiple assets as long as each individual purchase costs less than the threshold. There is no specific application form; you must detail the cost of the investment and its installation date on your tax return.

The Australian Taxation Office will automatically apply the write off to your taxable income. If you're unsure about whether you can claim for specific items, contact your financial advisor or tax specialist to ask.

Asset Write-off

The instant asset write-off can be a great help for many businesses. If you're looking to make a big purchase or take out a loan to buy a company car or equipment, consider whether you can make use of the asset write off scheme. Speak to a tax adviser about making the most of your tax deductions.

Our finance brokers can help you if you're thinking of making a significant purchase for your small business.

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

Comments (1)