Share this

The Basics Of Financing A Used Car [2024 UPDATED]

by Piera Rossi on Jan 28, 2022 11:16:56 AM

Buying a used car can seem daunting, but it's often a smart financial decision. Whether you're looking to ease your daily commute or planning for a road trip, a used car can be a practical choice. However, financing a used car can come with its own set of challenges. We'll take you through what a used car loan is, how to get the best deal, and what to watch out for. With the right information, you can secure your second-hand car with confidence.

Table of Contents

What is a used car loan?

How Do Used Car Loans Work?

What Are The Different Types of Used Car Finance?

What is considered a used car?

How to find the perfect used car loan?

Are there any restrictions on borrowing money for a used car?

Advice when choosing a used car?

Pros and cons of financing a used car

Saving money tips

Used car loans for ABN holders

Should a Used Car Loan Be in Your Future?

Bottom Line

FAQ's

What Is a Used Car Loan?

Firstly, let's establish what a used car loan is. Essentially, a used car loan is a car loan that helps you to finance the purchase of a second-hand car. Generally speaking, the vehicle has to be over a certain age. Otherwise, you may need to take out a different kind of finance with newer cars.

When you're approved for your car loan, the lender will provide you with the money needed. Unlike with a home loan, you won't typically have to give a deposit. Therefore, the loan provider will lend you the total amount required to cover the car.

Over an agreed loan term, you'll make set car loan repayments. These consist of the loan amount and car loan interest in regular instalments. Some car loans come with balloon payments at the end. This is when the final repayment is significantly more than the monthly repayments.

How Do Used Car Loans Work?

Car loans are straightforward agreements. For example, if you have your eye on an $80,000 car that is five years old but can't afford the funds immediately, you would approach a car loan aggregator. They'll check that you meet their lending criteria and find you the best car loan option within a pool of multiple lenders, then the lender will advance you the entire sum for you to purchase the car.

Loan terms generally last between 2 and 8 years. Let's say you have a loan term of four years and a fixed interest rate of 6.49%. You would pay $474 a week. After the four years is up and the final payment clears, the car is 100% yours.

Of course, it can get a little more complicated finding the right car loan and lender. You need to consider the car loan interest rate, comparison rate, loan term, and other factors. We'll help you through each step of the process to get the best car loan deal.

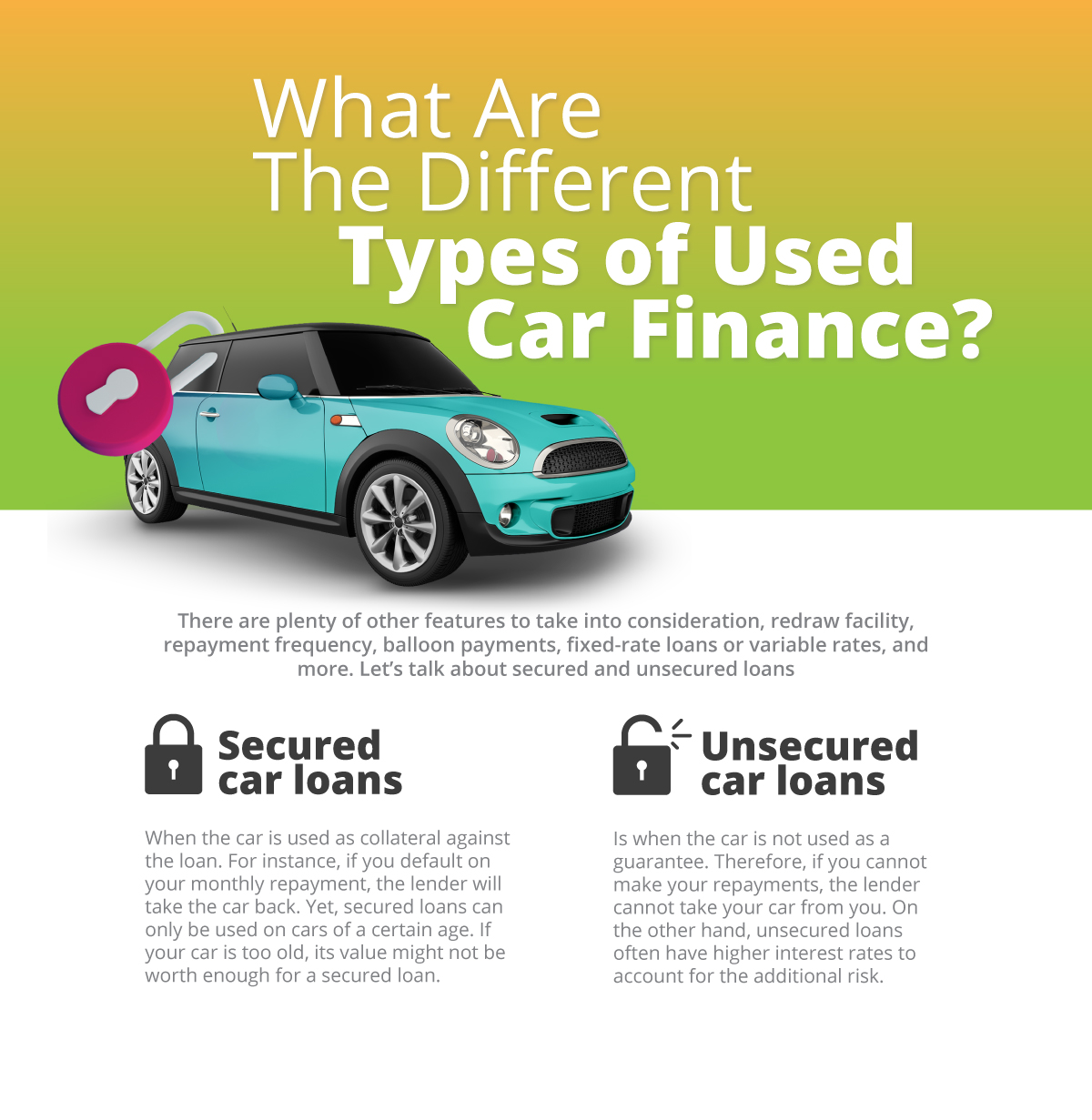

What Are The Different Types of Used Car Finance?

As with any kind of loan, there are many different types to consider. There are the usual fixed-rate loans or variable rate car loans. Fixed interest rates are when you pay a set rate for a period. If you want to budget your finances with expected monthly repayments, it works in your favour.

As with any kind of loan, there are many different types to consider. There are the usual fixed-rate loans or variable rate car loans. Fixed interest rates are when you pay a set rate for a period. If you want to budget your finances with expected monthly repayments, it works in your favour.

However, when the interest rate drops below your fixed rate in some months, you'll pay more than if you had a variable interest rate. Although the opposite is true, you'll pay less when the cash rate goes up. If you opt for a fixed interest rate car loan, then it's best to check the comparison rate. Often these types of loans come with other fees and charges.

Another consideration is secured or unsecured loans.

- Secured car loans: Secured loans are when the car is used as collateral against the loan. For instance, if you default on your monthly repayment, the lender will take the car back. Yet, secured loans can only be used on cars of a certain age. If your car is too old, its value might not be worth enough for a secured loan.

- Unsecured loans: An unsecured loan is when the car is not used as a guarantee. Therefore, if you cannot make your repayments, the lender cannot take your car from you. On the other hand, unsecured loans often have higher interest rates to account for the additional risk.

There are also plenty of other features to take into consideration. For example, are you allowed to make extra repayments? Or will you be subject to early repayment fees if you pay off your car loan early? Also, think about a redraw facility, repayment frequency, and balloon payments. If in doubt about which kind of loan is right for you, speak to an expert. We'll cover more about this later.

Finally, you can also secure finance for your used car directly with the dealership. Your car dealership will likely offer an attractive-looking loan. However, beware of heavy deposits and balloon payments.

What Is Considered a Used Car?

Used car loans differ from new car loans. For one, a new car loan typically has a lower interest rate than used car loan rates. Therefore, if you're looking to purchase a car, it's vital that you know whether it is classified as new or used.

Used cars depend on two things: age and how many miles it has. The best-used cars to buy have low mileage. Generally speaking, any vehicle over 1,000 miles should count as a used car. It's worth bearing in mind that the higher the mileage, the cheaper the vehicle. However, it's also less reliable and likely not to last as long.

How Old Can the Car I Want To Finance Be?

There is no magic number at which a car becomes used, and no longer new. Indeed, nor is there a fixed number of years at which it is too old for financing. It largely depends on your lender and the type of loan - speak to your broker about their requirements.

With secured used car loans, the lender can legally reclaim your car should you stop making payments. They'll sell it to offset their losses. Therefore, they might require your vehicle to be of a certain age (around seven years or younger) to ensure that it is worth selling. Generally speaking, they want the car to be no older than 20 years by the time the loan term is up.

Some lenders will allow slightly older cars. Plus, the lender won't have any legal claim to your vehicle with unsecured loans. Therefore, age is less important to them. But it's worth considering whether buying a really old car is practical.

How to Find the Perfect Used Car Loan

Finding the right lender from whom to borrow money is a big decision. Many lenders advertise low-interest rates, and you may think you have found the perfect car loan straight away. Yet, you need to look at more car loan options before settling. The car loan type, a balloon payment, used car loan rate, and the p.a comparison rate all affect the overall cost of the loan.

Here are some tips to consider when you compare loans.

Interest Rate

The lower the interest rate, the better. The difference between 0.1% in interest rates can be pretty significant. For example, if you want to borrow $10,000 over a three-year loan term on a second-hand car with an interest rate of 7.5%, the loan would cost $2,250 in interest.

Yet, if the used car loan interest rate is 10%, you'd pay $3,000 in interest. The difference of $750 is quite substantial. You can use an online car loan calculator to work out how much you'll pay.

Payment Flexibility

You can choose whether you repay your loan weekly, fortnightly, or monthly with most lenders. If you get paid weekly, it might work in your favour to make weekly repayments. Plus, with fortnightly payments, you'll make 26 payments. If you pay monthly, you will only make 12 payments.

Therefore, with more frequent payments, you might see yourself paying off your loan sooner as you technically make a whole extra monthly repayment.

Loan Term

The longer your loan term, the more interest you pay. On the other hand, each monthly repayment will be smaller as the cost is spread over a more extended period. Whether a shorter or longer loan term suits you depends on loan amounts and your financial situation.

Charges and Fees

Unfortunately, loans cost more than just the vehicle price and interest rate. You can expect to pay application fees. With some lenders, you might also need to pay monthly fees. Even just $10 a month can add up to an additional $360 on a three-year loan. Make sure to factor in these costs.

Vehicle Criteria

Not all lenders offer car loans for every type of car. You'll need to find someone who's willing to lend money for your specific car type and age. If you're buying a commercial vehicle, check whether your lender offers this type of loan.

Pre-approval

Your lender offers pre-approval, or conditional approval, as with a home loan, before confirming formal approval. This is not a guarantee that you'll receive the funds needed. However, it's an excellent way to get an idea of how much the bank is willing to lend, making it easier to negotiate vehicle prices with the vendor.

Early Repayment Fee

Some loan types don't allow borrowers to make additional payments to repay their loan sooner. It's nice to have the flexibility to repay your loan whenever you choose. For example, if you get a pay rise, paying off your loan more quickly will save you potentially hundreds in interest.

Other Features

Used car loans come with all sorts of additional features that make repaying easier. You might want a redraw facility. This is where you access and withdraw any other payments you have made towards your loan.

Are There Any Restrictions on Borrowing Money for a Used Car?

Most lenders are willing to provide finance to buy new and used cars. As long as you meet their lending criteria, you should be able to secure funds quickly.

The lending requirements vary from lender to lender. Additionally, different types of loans have various eligibility criteria. For example, secured loans are preferred by the bank. Therefore, those with poor credit history may struggle to get an unsecured loan.

There are very few instances where you will be outright denied approval for your car loan. While secured loans are preferred, finding an eligible used car might be challenging. As the car you buy is used as security against the loan amount, the lender wants to ensure it's not over a certain age. The maximum age accepted depends on the lender.

However, you should check the requirements before applying for a loan.

Other instances in which you may struggle to get loan approval are the same as any loan type. For example, poor or no credit history or lack of income evidence may work against you.

Advice When Choosing a Used Car

Buying a used car is different from purchasing a new car. With the latter, you can generally trust that it will last for a good number of years, run reliably, and be worth the money. However, used cars are highly variable. There are a number of factors to take into consideration when shopping around for your used car.

1. Budget for car ownership costs

This includes fuel, insurance, registration, and maintenance. Older cars are generally cheaper to insure because they are usually lower in value. However, maintenance costs could be high. Used cars are far more likely to break down, need parts replaced, or pack it in entirely.

2. Prefer younger vehicles with lower mileage

When you're comparing used cars, try to find younger vehicles with lower mileage. Stay wary of any cars that have had replaced parts or a history of breakdowns. It's okay to question the car dealer or private seller about the car's history.

3. Consider insurance costs

With a used car, you face the possibility of having to repay the car loan if the vehicle stops working. You would have to pay off your existing car loan and buy a new car in such a scenario. There are some insurance policies available that protect you in such cases. However, this is another cost to factor into your monthly account keeping fees.

4. Consider differences between buying from a dealership or a private seller.

Dealerships might be more trustworthy. However, you can find some really great deals from private sellers. Plus, it's easier to negotiate with a private vendor.

Whereas dealers sell used cars at slightly marked-up prices to cover their overheads. Also, they might try to convince you to fund your purchase with their chosen lender. As we mentioned earlier, these loans often come with a final lump sum payment that can catch you out. Yet, they're more likely to offer warranties and legal protection.

Pros and Cons of Financing a Used Car

Used cars are significantly cheaper than new cars. With many excellent deals, you may not even need to secure a car loan. Here are the pros and cons of financing a used car.

Pros

- Generally, used cars are a lot cheaper. Even with factoring in the cost of maintenance and higher insurance rates, buying a used car is more affordable.

- Even if you have a restricted budget, you are more likely to be able to secure the make and model of the vehicle you want.

- The depreciation of a used car is far lower than that of a new car. Therefore, if you choose to sell it on, you won't have lost as much money as if you resell a vehicle you purchase brand new.

Cons

- Interest rates for used cars are typically a lot higher than for new vehicles. This is especially true of unsecured loans.

- It might be more complicated getting your finance approved. Older cars are riskier to the lender. Therefore, aside from raising interest rates, they might deny your application entirely.

- Older cars have more limited loan options. As fewer lenders are willing to let you borrow for older cars, you won't have as wide a range of loan choices as with a new car.

Saving Money Tips

While you want to get excellent loan terms for your used car, there are other ways you can save money too. Here are a few of our money-saving tips that will help you down the road.

Consider Less Popular Models

Just as with new cars, certain brands and models are sold for marked-up prices due to their popularity. For example, Mercedes Benz cars are often significantly more costly than the less popular brands. The same is true of used cars. The more expensive the original purchase was, the more you can expect to pay for the used version.

Accordingly, it's best that you don't fixate on a specific brand, model, or trim. Try to be open to rival models. There are many reasons why less popular models are excellent purchases. Firstly, competitive car manufacturers are more likely to introduce more extended warranties and better standard specifications.

Buy Privately

We touched on the advantages and disadvantages of using car dealerships earlier. If your priority is to save as much money as possible, then you might want to buy from a private seller. You won't get a warranty or legal protection.

However, you might be able to save yourself a couple of thousand dollars. If you're not an expert on cars, try asking family or friends to help you. Or, ask for a prepayment inspection (although this usually costs, it can save you pain later on).

Negotiate

Haggling might seem like a scary prospect. However, most car dealers and private sellers will expect you to try and negotiate. Their asking price is often higher than what they're willing to sell for.

The best way to barter is to point out aspects of the car that you're not happy with. It could be anything from heavily worn tires to chips in the paint. Take time to research the car model. Are there any common issues that others have found with it? Also, look at other cars on the market. How much are they selling for?

Phrase your negotiations positively. Rather than demand you want money off, ask how much the seller is willing to lower their price by. This will go a long way in subconsciously influencing them. Moreover, you should never let the other party know your budget.

Finally, your best technique is knowing when to walk away. If the vendor isn't willing to settle on a price that you're happy with, then remember that there are probably better options elsewhere.

Previous Generation Model

If your desired car has had a recent update or restyle, then the older generation will probably have dropped significantly in value. While it may not be your dream car, you'll save a lot of money this way.

Consider Trims

While it's tempting to want every feature on offer, consider whether you really need them. The simpler your car, the cheaper it will be. If you're willing to sacrifice a few trims, you might save hundreds or thousands of dollars.

Mileage

The general advice is the lower the mileage, the better. However, used cars with low mileage tend to be significantly more expensive. Consider what you need the vehicle for. If you're planning on making short trips around your local area, you don't really need a car with low mileage. If the car is in otherwise good condition, don't discount it.

Moreover, modern engines work better when up to full operating temperature. With short runs, the car doesn't get put to temperature. Plus, urban roads can be more harmful to the suspension of the car. A vehicle with a higher mileage likely made fewer short, damaging journeys.

For example, a car with 20,000km all around town might be in worse condition than a car that has covered 50,000km on motorways (which has far better maintenance), then it should be cheaper and in better shape.

Used Car Loans for ABN Holders

ABN car loans are for those who cannot supply the required two years worth of financial documents. They are primarily based on the applicant's ABN. Essentially, it means that sole traders and business owners can apply for car loans without meeting the eligibility criteria for a standard loan.

ABN car loans are usually as flexible as normal ones. You can arrange for a loan term between one and eight years and opt for a balloon payment.

The benefits of ABN loans are:

- Tax-deductible interest

- Claim depreciation

- Claim GST

Should a Used Car Loan Be in Your Future?

When contemplating a used car loan, consider:

- Your Finances: Take a hard look at your financial landscape. Think about upcoming expenses and potential future needs.

- Immediate Needs: How urgently do you need wheels? If you're juggling daily responsibilities or work that needs a car, a used car loan could be the timely solution you're looking for.

- Do Your Homework: Before you jump in, spend a little time getting to know the market. Check out different lenders, interest rates, and terms. And if you’re looking to cut through the noise, Ausloans can simplify the journey, offering solutions to suit your needs.

Bottom Line

Getting a used car loan today follows the same basic principles as it has in the past. Buying a used car over a brand new model is an excellent way to save thousands of dollars (sometimes even more) on the vehicle you want. You don't need to worry about depreciation or a restricted budget.

To ensure you get the best possible deal on your car loan and purchase, make sure you shop around. Opt for less popular models and older generations. Even consider whether cars with higher mileage are actually in better condition than those with low mileage.

Remember to look at different lenders. Take into account interest rates, comparison rates, and additional features. Finally, decide whether a secured or unsecured loan is the best choice for your situation. Everyone's finances are different. When it comes to choosing your loan, there's no right or wrong answer.

FAQ

How Old Can My Car Be?

Lenders offering used car loans each have a different set of requirements. While some might offer finance for cars ten years old or more, others won't approve loans for any vehicle older than five. Generally speaking, most lenders will approve a loan application for any car seven years or younger.

A good rule of thumb to remember is that if the car is 12 years old when the loan term ends, you should be able to secure finance.

Do I Need Insurance?

The most considerable risk with buying a used car is that it breaks down before you've finished paying it off. The loan repayments don't stop just because the car is dead. Therefore, you might find yourself paying for two vehicles. If you're worried about such scenarios, there are insurance policies that can protect you.

Can I Get a Used Car Loan if I Have Bad Credit?

There is no minimum credit score required to get a car loan. Some lenders might ask you to pay a deposit or raise their interest rates. However, it's not impossible. You might just need to shop around to find the right lender or loan.

Can I Get Approved for a Used Car Loan if I Am Self-Employed?

Self-employed Australians can apply for ABN car loans. With such loans, the lenders use different ways of judging your risk levels, such as your APN number or business financial statements. Plus, you can deduct interest, GST, and depreciation from your taxable income.

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

Comments (1)