Share this

Chattel Mortgage Car and Equipment Loans for Business | The Guide

by Chris Hopkins on Oct 29, 2021 9:43:36 AM

There are several different loan options available to business owners operating in Australia. So, when it comes time to take out a loan on a piece of business equipment or car, you might feel a little lost. That's where so-called chattel loans come in.

The term "chattel" simply refers to movable personal property or personal property that can be moved. So, motor vehicles, construction equipment, and aircraft are all classed as chattels. They are all, unsurprisingly, expensive. Rather than pay upfront, chattel mortgage loans allow business owners to spread the costs over monthly repayments.

If you want to know how you can mortgage a chattel, the information contained in this article should answer all your questions. From how a chattel mortgage works to the pros, cons, and frequently asked questions, here's what we'll cover:

What Is a Chattel Mortgage?Who Are Chattel Mortgages For?

Chattel Mortgages for business

How does a chattel mortgage work?

How to apply

Benefits of a chattel mortgage for business owners

Disadvantages of a Chattel Mortgage.

Chattel Mortgage Rates.

Chattel Mortgage Car Loans.

Chattel Mortgage Vs. Lease.

Chattel Mortgage FAQ's

Equipment Finance: All You Need to Know About Chattel Mortgages.

What Is a Chattel Mortgage?

Simply put, a chattel mortgage is a type of finance agreement for businesses. As mentioned above, it is a vehicle or equipment loan that allows business owners to purchase an asset through regular repayments.

Crucially, chattel mortgages are not unsecured loans. And, just like a standard mortgage, the lender uses the chattel as security for the loan. In other words, they have a stake in the vehicle throughout the loan. Then, once all payments have been made, the borrower takes full ownership of the vehicle.

Chattel mortgages are ideal for businesses hoping to finance an asset without paying outright. Also known as "personal property security" and "movable hypothecation", they allow business owners to invest in expensive vehicles and equipment more easily.

Who Are Chattel Mortgages For?

It's important to note that this type of loan can only be used for business purposes in Australia. So, businesses in need of vehicles or heavy-duty, movable equipment can finance them with chattel mortgages. Meanwhile, in the United States, Britain, and elsewhere, chattel mortgages are available to average consumers, too.

That's actually how a lot of other loans work in this country. Here, home loans or car loans can be taken out by consumers for non-commercial reasons. But, when it comes to a chattel mortgage, businesses are the only entities entitled to apply.

Chattel Mortgages for Business Use

There are plenty of reasons why a business might need a chattel loan. For one thing, it might not have the budget to finance a car or equipment without one. Depending on the business’s financial situation, a chattel mortgage could be the most viable financing option available. Work out if it's the right choice for you with a chattel mortgage repayment calculator.

In addition, there are several advantages, which we'll discuss in greater depth shortly. They include flexibility and the ability to claim tax deductions on the loan interest. So, as long as they're savvy and work with a reputable credit provider, chattel mortgages make a lot of business sense.

How Does a Chattel Mortgage Work?

Financing equipment, a car, or another vehicle with a chattel loan is relatively straightforward. In fact, it's a lot like applying for other secured loans. When you sign your contract and take out the loan, you commit yourself to paying back the cost through monthly payments. Once all the money has been paid (plus interest), you then take full ownership of the asset.

Much like other loans on the market, there are different loan types you can choose between. These include fixed-rate and variable rate chattel loans. With a fixed-rate loan, your monthly payments stay the same from start to finish. This is because the interest rate is set in stone when you sign your contract.

Alternatively, you could take out a variable rate loan. Here, the interest on the loan will change in response to market forces. So, some months you'll pay more and others less. The hope is that, overall, you end up paying less than you would with a fixed-rate loan. However, that isn't guaranteed.

Read on for more information about finding and applying for loans that suit your business.

How to Apply for a Chattel Mortgage

Traditionally, the best way to start used to be with some research into loan providers. Some have better reputations than others and can offer better loan terms, too.

However, with advances in finance technology, the easiest way is to let our software do the research for you. At Ausloans our lending tech, Zink, does all the heavy lifting for you. You can save yourself hours in unnecessary lender research by simply submitting a fiance inquiry.

To get started simply use our online app to complete a finance inquiry and within minutes we will be able to assess your credit profile against the lending criteria of over 40 lenders and deliver to you a list of real offers, from real lenders with real rates.

Worried about damaging your credit score. We've got you covered. Our finance inquiry will not impact your credit rating. Simply click the banner link below to get started. The inquiry only takes a few minutes and at the end, you will know the options available to you. From there it's up to you to choose the best chattel mortgage option for your circumstances

.When you mortgage a chattel, you'll need a good credit score and, in some cases, an upfront deposit. However, you may instead be able to finance 100% of the loan, although that will depend on your financial situation and the lender.

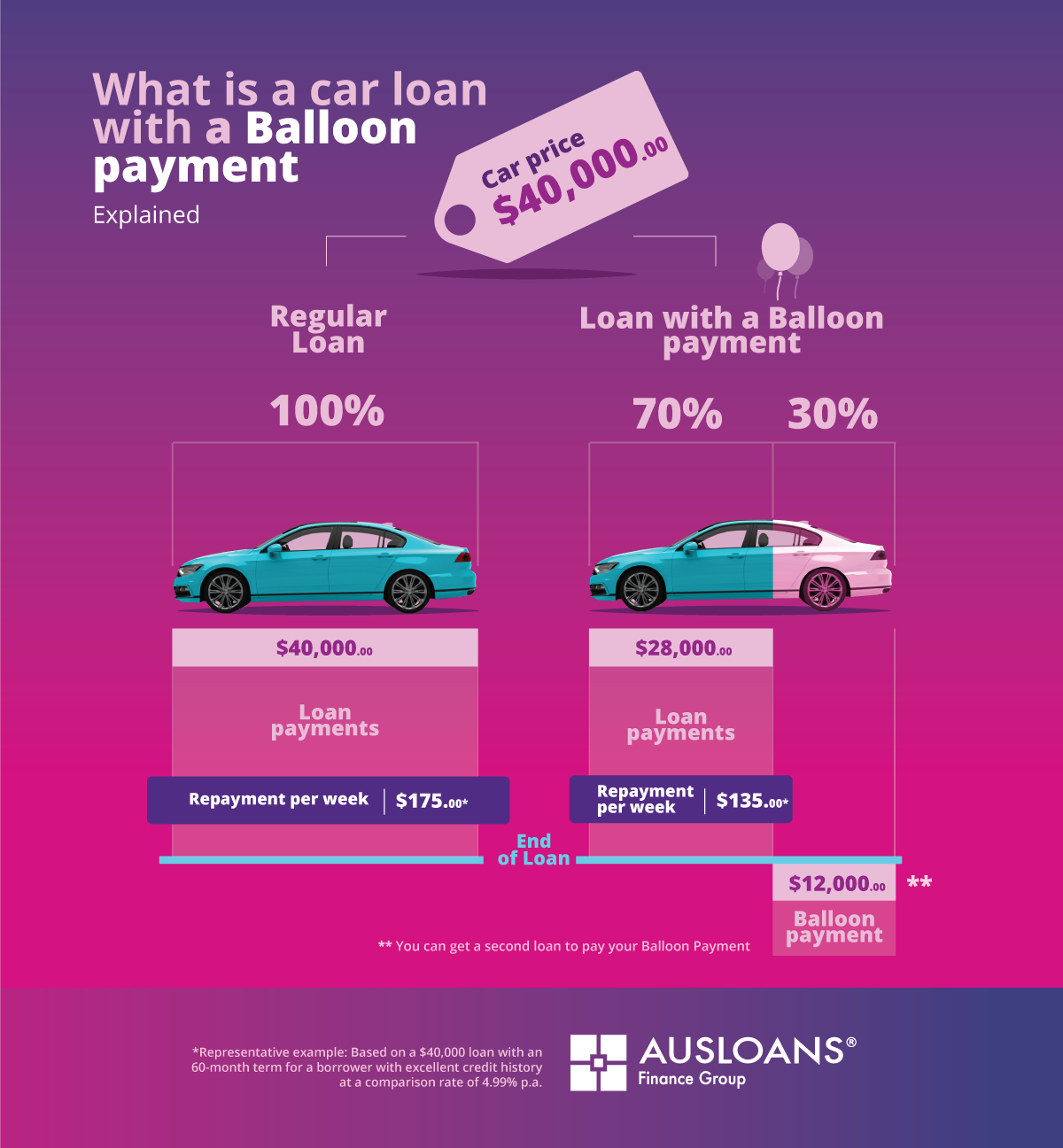

Depending on the lenders available, you might be able to set up a balloon payment to drive down the cost of your weekly repayments. This could be a good idea if your provider charges additional monthly fees.

Benefits of a Chattel Mortgage for Business Owners

There are lots of reasons why taking out a chattel mortgage could be a good idea for your business. From the ability to purchase beyond your budget to payment and tax benefits, here are five key reasons to consider a chattel loan.

1. Purchase Assets for Business Use

Lots of different types of business need a car or equipment. However, not all businesses can afford to foot the hefty bills associated with buying these vehicles outright. But that doesn't mean that those necessary assets are out of reach. With a chattel loan, smaller businesses, sole traders, and companies with strict budgets can afford the equipment they sorely need.

In doing so, businesses can avoid negative cash flow by taking out loans that don’t cause financial disruption. With manageable repayments and low or no monthly fees, businesses can purchase vehicles they may otherwise have struggled to finance.

2. Flexible Monthly Repayments

Not only can business owners spread the cost of the purchase price, but they can also do so in a way that suits them. Borrowers can, for example, set the length of their loan term to suit their needs. They can also select how much they want to put down as part of their upfront deposit. And, they can decide between a fixed rate and variable rate mortgage.

Check out the terms and conditions of any of the providers you're considering. They might offer added perks as part of your contract. It's worth knowing if you'll be able to make additional repayments or whether your provider offers a balloon payment. And, no matter what you're looking for, always use a chattel mortgage calculator. It's the best way to compare providers, their rates, and associated advantages.

3. Lower Interest Rates

Since chattel mortgages are secured, the interest rate is generally lower than it would be for an unsecured loan. A personal loan, for example, does not provide the lender with the same security, because there is no collateral. So, lenders charge a higher interest rate to compensate for the added risk. Therefore, whether you opt for a variable or fixed interest rate, you can expect to pay less on your chattel mortgage repayments.

4. Tax Benefits

Some of the most attractive advantages of chattel mortgages relate to tax. You see, as a business owner, the interest on your loans can be claimed as tax deductions. So, any interest paid on your financed asset can be retrieved come tax time. However, keep in mind that this only applies to loans taken out for business purposes.

Just as you can claim interest on a chattel loan, you can also claim Goods and Services Tax (GST). This includes the GST on the principal amount, which you can claim as an Input Tax Credit. To do so, you must register to collect GST through your Business Activity Statement.

You may be able to claim the depreciation of your vehicle as an additional tax deduction. But, there are depreciation limits and rules laid out by the Australian Taxation Office that you should check out first. It may also be a good idea to seek professional advice. A professional could help you claim GST, interest, and depreciation costs through your next business activity statement.

Disadvantages of a Chattel Mortgage

As with all financial products, there are some potential drawbacks to be aware of. While they don't necessarily negate the advantages of chattel loans, they might make them less attractive to some borrowers.

Whether you need a chattel mortgage for a car loan or equipment loan, it's worth weighing up the cons before putting in an application.

Keep reading to find three of the key points to be aware of, including common regulatory and security concerns.

1. Not Regulated

First and foremost, a chattel mortgage will not be regulated under Australia's National Consumer Credit Protection Act of 2009. The act was introduced to offer consumers greater protection when borrowing. It applies to things like personal loans and credit cards.

Still, you don't need to be too concerned. Thankfully, there are a couple of things you can do to assure your safety. One is always checking that the finance company you apply through has an Australian credit license from ASIC. Another is to compare rates and read the fine print carefully before agreeing. Take these simple precautions and you'll easily find a great deal from a reputable company.

2. Security of the Asset

With chattel loans, like home loans and car loans, the asset you're financing is secured. As such, your finance company will hold a stake in the vehicle or equipment until you repay the full amount. So, while the asset is more secure for the lender, it is less secure for the borrower.

Say, for example, you reach the end of your loan term and there is a residual payment left to cover. If you do not have the residual amount there and then, you could lose the vehicle. But, as long as you apply for loans with realistic terms, this shouldn't be an issue.

3. Shorter Loan Terms

Chattel loans often have to be repaid more quickly than other mortgages. So, the loan terms are generally shorter. This means that, while there's flexibility in how you pay back your loan, it's unlikely you'll be able to drag your monthly repayments out for too long.

For businesses hoping for more repayments at a lower rate, this might be cause for concern. However, some lenders do offer longer loan terms. As ever, it's worth doing your research before you make any final decisions and the fastest and easiest way to do that research is by submitting a chattel mortgage fiance inquiry through Ausloans.

Chattel Mortgage Rates

So, we know the pros and cons of chattel loans, including improved cash flow and regulatory concerns. Now it's time to look at the rates. In Australia, chattel mortgage interest rates are fixed between 4.00% and 6.00%. The exact rate you receive will depend on several factors.

Firstly, the lender you apply through will set their own rates. As such, the offers you find for the same loan terms will vary depending on the company. The type of asset you want to finance will play a role, too. Generally speaking, the newer the vehicle, the better the rate.

Of course, your personal information will also be factored in. This includes your credit score and cash flow or turnover. Bear in mind that borrowers with good credit scores and a secure income are much more likely to get favorable rates. They may also get benefits, including the ability to make early repayments for free.

Chattel Mortgage Balloon Payments

If you wanted to keep your monthly repayments way down, you could opt to have a balloon payment. A balloon payment is a percentage of an asset's purchase price that is paid at the end of the loan term. Crucially, you do not have to pay interest on a balloon payment, also known as a residual payment or residual amount.

Balloon payments are often capped at 50% of the principle. So, if you agree to a 50% balloon, you would pay the other 50% back in monthly installments. Only the monthly payments accrue interest. And, because they're a smaller proportion of the principle, they are cheaper than standard loan repayments.

Take a look at a chattel mortgage calculator and find out whether you'd benefit from a balloon payment.

Chattel Mortgage Fees

Whether you're aiming to drive down your monthly outgoings or not, it's important to keep an eye out for hidden fees. There are lots of attractive-looking loans out there. Unfortunately, though, they are not all as they seem.

In some instances, you'll find that a lower monthly rate doesn't make up for the excessive fees charged on top. These may include, but are by no means limited to:

● Processing fees.

● Maintenance fees.

● Prepayment fees.

● Late payment fees.

● Cancellation fees.

● Charges for changing payment methods.

There may be others depending on the finance company. You have to be savvy to avoid these excessive upfront costs and staggering monthly charges.

Chattel Mortgage Car Loans

To take out a chattel mortgage car loan the vehicle must be used predominantly for business. In effect, this means that your vehicle needs to be used for business purposes more than 50% of the time, If you are using your vehicle regularly for work purposes a chattel mortgage may be a great solution for you.

As Australia's largest independent asset finance brokerage, Ausloans is well-positioned to help you secure the best chattel mortgage vehicle or equipment finance for your business. Our extensive commercial lender panel allows us to provide lending options for all types of businesses, regardless of size, financial profile, or length of operation. The only requirement to qualify to apply for a chattel mortgage loan is that your business has an ABN and the asset you wish to purchase will be used for business more than 50% of the time.

Chattel Mortgage Car loan Vs. Lease

There are alternative options available if you're hoping to finance a car, vehicle, or equipment for your business. So, if a chattel mortgage doesn't seem like the right choice for you, you could consider leasing. It’s a better fit for some borrowers than others. It all boils down to individual circumstances, so think carefully about what each option offers.

While a chattel mortgage promises full ownership at the end of the loan term, a finance lease is more like renting. Here are some of the key differences between the two to help you decide which might be best.

What's the Difference Between a Chattel Mortgage and a Lease?

The key difference is that a chattel mortgage is a loan you pay off over time. Once you repay the money plus any interest, you then own the asset. On the other hand, with a lease, you pay to use the vehicle for a specified period. In other words, the vehicle is not yours and will not become yours.

Typically, lease terms are determined by several key factors. These include how long you want to keep the vehicle and how many kilometres you intend to do. If you end up covering more ground than stipulated in your contract, you could end up paying additional charges.

Although the asset is never yours, you have to care for it as though it is. As such, whether you lease or finance, you'll have to cover registration and servicing costs. With a leased vehicle, these additional costs could make the proposition seem less enticing. However, it might be worth it if you know you only need the vehicle for a set number of months.

Chattel Mortgage or Lease: The Right Financing for Your Business

Ultimately, the question of which finance option is right for you comes down to your needs. If you need vehicles or equipment to be a permanent fixture in your business, a lease probably isn't the right way to go. Similarly, if you only need a vehicle in the short term, chattel mortgaging won’t be worth your while.

If you're still on the fence, there are other considerations to take into account. For example, do you think you'll need to upgrade the asset in the near future? If so, you might think a lease would be the best option. But, are the tax benefits worth a longer-term commitment? And how much would your business likely pay throughout a loan term versus a lease term?

These sorts of questions are critical to helping you find the ideal financing solution.

Frequently Asked Questions

There is so much to know about chattel mortgages. That's why you need to do your research before you put in an application. Otherwise, you could end up with unfavorable loan terms or, worse, applying for unsuitable finance. To help you out, we've rounded up a couple of the most frequently asked questions. Check them out below.

What do I need to qualify for a chattel mortgage?

To qualify for a chattel mortgage loan you need to have an ABN. Any asset you finance with a chattel mortgage must be used 51% of the time or more for business purposes. And, unless you finance 100% of the loan, you will need an upfront deposit. To qualify for good loan terms, a good credit score is also necessary.

How do I qualify for the best rate on a Chattel Mortgage?

Qualifying for best rate chattel mortgage finance is no different from qualifying for best rate consumer car finance. The interest rate you are offered by a lender is determined by the level of perceived risk in lending you, the borrower, the money. In simple terms, the lower the risk, the lower the interest rate.

So what are the key influencers in determining your rate? While every lender lending criteria is different, key factors that influence the rate you are offered include the type and age of the vehicle, the amount you wish to borrow, the term of the loan and of course your credit history and income.

Can I Use a Balloon Payment With a Chattel Mortgage?

Yes, you can use a balloon payment with a chattel mortgage, although not all providers will offer residual payment options. A balloon payment is a percentage of the purchase price you agree to pay at the end of your loan term. It can minimise the interest you have to pay and reduce monthly repayments.

Equipment Finance: All You Need to Know About Chattel Mortgages

A chattel mortgage could be the ideal finance option for your business. If you need to invest in a vehicle but don't have the cash, you can borrow the money from a finance company. While you make your repayments, the lender will retain a stake in the asset. But, by the end of the term, it will be entirely yours.

Although they come with plenty of advantages, it's important to be vigilant. You need to find a loan that suits your financial situation. And, you must sign with a trusted finance company that holds an Australian credit license.

To make the process easier, check out the Ausloans online chattel mortgage comparison tool. It's a hassle-free way to find attractive loans from vetted lenders. Not to mention the fact that it's easy to get in touch with our finance experts. So, it's the best place to seek advice and find factual information that will help you.

Got more questions about car loans? Check out our car loans guide

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

No Comments Yet

Let us know what you think