Share this

Pre-Approval For Car Loans - What Does It Mean And Why Is It Important in 2024?

by Piera Rossi on Feb 10, 2022 3:05:04 PM

If you're looking to finance your new car purchase, applying for a car loan pre-approval will go a long way to securing your dream car. While purchasing a new car can be exciting, it is also a stressful time, mainly when sorting out your finances. Getting pre-approved for a car loan will help you negotiate with the car dealer and remind you of your budget limitations.

With pre-approval, you'll be better prepared to begin car shopping. We'll take you through what pre-approval is, how it works, and the process of applying.

What is a loan pre-approval?

How car loan pre-approval works?

Why getting pre-approved for a car loan is important?

Pre-approved car loan features

Does Pre-approval Mean That My Loan Is Guaranteed to Be Approved?

Do Pre-approvals Affect My Credit Score?

Things to Consider Before Applying for Pre-approval

Are There Any Extra Costs I Should Be Worried About?

How Long Does Car Finance Pre-approval Take?

What Happens After Pre-approval?

What Are the Pros and Cons of Car Loan Pre-approval?

How to Get Your Loan Pre-approved Today: Completing the Application Form

What Is Loan Pre-approval?

Pre-approval, also known as conditional approval, is when you superficially meet the lender's criteria. The lender will run a soft credit check when you initially apply online. They might ask you how much you'd like to borrow and the type of loan you want. Although, they usually reserve information about the specific vehicle until later.

You might also need to provide further details about your financial situation, such as your income and whether you have a down payment.

If you meet the lender's basic requirements, then they'll offer pre-approval. They will provide a quote for how much they're willing to offer. However, it's worth remembering that this is not a guarantee of formal loan approval. The offer is unconditional when you're formally approved for a car loan. Essentially, unconditional approval is what it suggests - you'll get the funds for the car.

The lender will run a hard credit check on you before this final approval.

How Car Loan Pre-approval Works

Not all financial institutions offer pre-approved car loans. Those that do will make it clear how to apply. Many let you apply online. At Ausloans Finance you can simply apply online and get car loan pre-approval within 24 hours.

Typically, the main requirement is your credit score. The lender will run a soft check to ensure that you're not a risk. A poor credit score doesn't mean that no lender will offer you a loan. However, you may need to approach specific lenders who will be more amenable. Poor credit may also result in higher interest rates.

The lender will also check your gross income or monthly salary. They need to determine whether you'll be able to repay the loan on time based on your current income. If you're on a lower wage, you can increase your borrowing power by saving up a deposit. They'll also check any other sources of income. These could include:

- Disability

- Retirement

- Child support

- Alimony

Once they have a robust idea of your financial circumstances, they will make their decision. If you're approved, then this is because the lender believes that, in principle, you will be able to repay your loan.

What if I Can't Get a Pre-approved Car Loan?

There are a few ways you can ensure that you get approved for a car loan. Firstly, consider the type of loan you're going for. If you can't afford the monthly repayments of one loan, you might think about increasing your loan term or opting for a cheaper car model. While a new car costs more upfront, used vehicles tend to have a higher interest rate.

Secondly, boost your credit score. Bad credit history is typically a result of late payments or a poor credit utilisation ratio. Make an effort to repay your credit card and other loans on time. Set up reminders on your phone or use a calendar. Ensure you pay off any outstanding debts.

Credit utilisation is how much available credit you have and use. If you have three credit cards, each with $5,000 limits and over $4,000 on each, your credit utilisation ratio will be high. Subsequently, this will negatively affect your score.

Thirdly, if you cannot afford your dream car now, consider saving up and trying again in the future. Can you supplement your income or budget differently to improve your savings?

Finally, it's worth thinking about finding a co-signer. With two incomes, the lender will deem you less risky and is more likely to offer pre-approved car finance.

Why Getting Pre-approved for a Car Loan Is Important

When you start car shopping, you might not have a solid idea of what you can afford to buy. Creating a budget will help. However, it's not until you get pre-approved for a car that you can approach a car dealership with your offer. With a quote from your preferred lender, you can improve your bargaining power and buyer confidence.

Why is getting your car loan options approved by a relevant credit provider essential?

It's a great way to let dealers know you're a serious buyer. With car loan pre-approval, you can prove to dealers that you have done your homework. Therefore, you'll likely be able to negotiate more powerfully.

Also, you won't need to rely on dealer finance. Many car dealerships offer their own car loans at attractive-looking rates. However, they can hide extra costs and loan terms. If you have already organised your car finance options, then the buying process will be less stressful.

Plus, you will avoid being persuaded to include all the features offered by the dealer. When they try to convince you to purchase add ons, you can deflect. Say, "I'm approved for this loan amount, so I'm not going to go above it." It'll save you from spending more than you wish to.

Additionally, you'll be able to relax looking for your next car. Rather than spend your time worrying about financing and whether you'll find the right car loan, you can comfortably shop, knowing what you can and cannot afford.

Pre-approved Car Loan Features

Shopping for your car loan early is the best way to secure any features relevant to your particular product. If you leave car loan pre-approval to the last minute, you risk signing for car finance that isn't 100% what suits your personal circumstances.

The assistance of a car loan broker can help you secure loan features, help you through the pre-approval process, and offer personal advice. Here are some of the best features on the market.

- Secure your loan amount against your vehicle. Secured loans typically have lower interest rates. Therefore, you'll save money and maintain manageable payments. Unsecured loans (where the car is not used as collateral) have higher interest, yet, the lender has no legal right to your vehicle should you default on a payment.

- You'll have plenty of time to choose between fixed or variable interest rates. The benefit of fixed-rate loans is that you can predict each month's payments. However, if the interest rates fall, you might be paying more. Variable-rate loans are more flexible. Yet, fluctuating interest rates may not suit you.

- Loan terms are typically between one and seven years. Longer loan terms can help you make more affordable monthly repayments. However, they are also more expensive on the whole as interest accrues over longer.

- Weekly, fortnightly, or monthly fees option. Most lenders enable customers to choose the frequency of their repayments. The advantage of fortnightly is that you actually pay the loan off quicker. There are 26 fortnights in a year. So, effectively, you'll pay an extra month's payment each year.

- The ability to make extra payments - many lenders charge early repayment fees. If you have the chance, you can find a loan that doesn't make you pay early exit fees. You can also negotiate a redraw facility to ensure flexibility with your loan repayments.

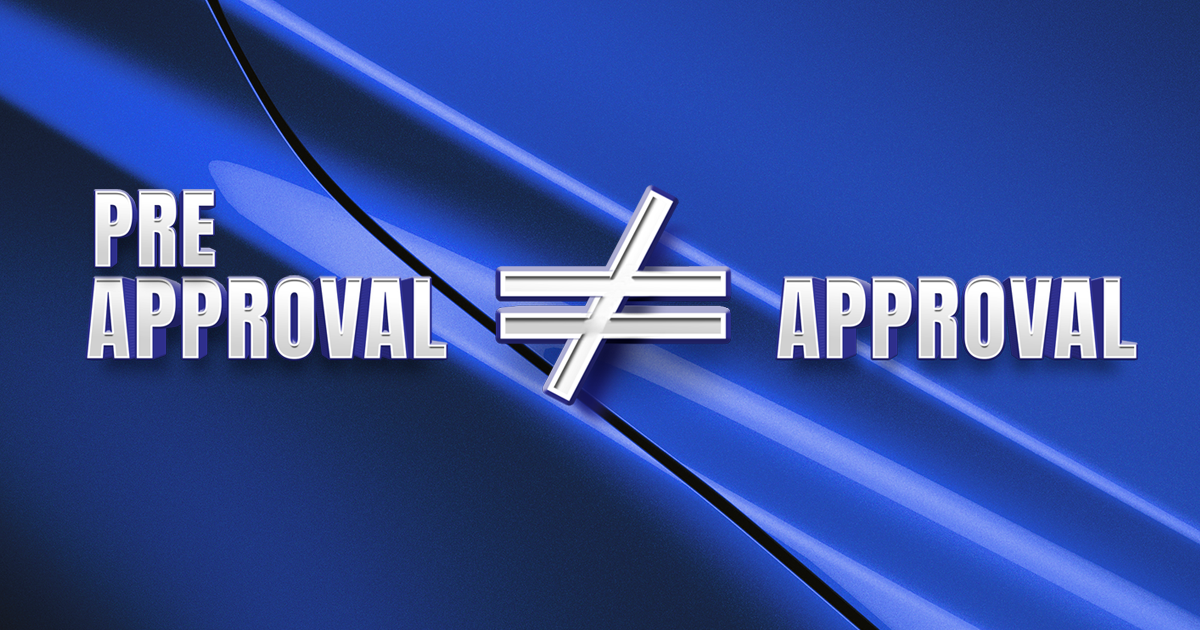

Does Pre-approval Mean That My Loan Is Guaranteed to Be Approved?

Pre-approval only means that your car loan is approved in principle. Essentially, the lender says that you meet all their lending requirements as far as their basic checks can go. However, after offering pre-approval, they'll conduct a more thorough analysis of your financial situation. If they still deem your application vital in their final assessment, they'll provide unconditional approval.

Pre-approval is not a guarantee that you will receive your loan. It's a strong indication of your financial position and gives you a good idea of loan amounts. But you cannot rely on it.

Once you receive pre-approval, you'll know how much you can spend on your vehicle. However, you don't have to borrow the entire loan amount. In fact, it's often more sensible to borrow less than the lender is willing to offer.

To progress to the next stage, you'll need to submit your vehicle details to the lender. This is the time to check that your desired new or used car is eligible for the loan product.

Do Pre-approvals Affect My Credit Score?

As part of the car loan approval process, you must authorise the lender to review your credit report. They'll access this from one of the leading credit agencies (Experian, Equifax and Illion). Once they obtain the credit scores based on the report, this will trigger a hard inquiry. This will appear as a notation on your report.

Hard inquiries are associated with the acquisition of debt. Therefore, they inevitably will cause your credit score to dip. That said, the reduction is slight and short-lived. The hard inquiry will disappear from your credit report entirely after two years.

Yet, it is essential not to authorise multiple lenders to make hard inquiries. If you apply for a car loan pre-approval with several lenders and any are denied, they will show on your credit report. Subsequently, other lenders will assume poor financial health, and you may struggle to get future loans, such as a home loan.

Things to Consider Before Applying for Pre-approval

There's a lot to think about and do before buying a car. The same is true of applying for pre-approved car loans. Here are a few things to keep in mind.

Research your desired car. Learn everything you can about the make, the model, the year, the colour, and fuel consumption. If it's a used car, have there been any problems with it in the past? Is it worth the negotiated price? Are there any reasons why you shouldn't purchase the car? You need to make sure that it meets your pre-approved car loan criteria.

Along similar lines, take your car for a test drive. Until you actually get in the driver's seat, you cannot guarantee that this is the perfect car. Test-driving your new vehicle will enlighten you about any issues with it (especially the case with used cars). If there are any faults, you can use these in your negotiations. For example, if you notice a technical defect, you can use this to haggle down the price.

Also, take notice of dents, chips, worn tires or incomplete service history. These can also be used to lower the price. Remember, just because the lender pre-approved you for a specific amount doesn't mean you have to spend the entire thing.

Determine your financial situation. Car loans are a significant financial commitment. If you have pre-approval, the lender will have valued you able to follow through with your financial payments. However, can you guarantee that you have the required funds? Moreover, do you want to part with such an amount of money?

Shop around. Just as the first loan you saw wasn't your only consideration, you should check out multiple lenders. You may find similar cars elsewhere at better prices. Knowledge of other dealerships will also help your negotiation tactics and confidence.

Are There Any Extra Costs I Should Be Worried About?

The costs don't stop with the loan. Unfortunately, buying a car is expensive. The loan itself and interest have an extensive effect on your finances. Yet, your budgeting should consider further expenses.

Stamp Duty

It's mandatory to pay stamp duty on your car. It differs from state to state but is usually a percentage of the purchase price. In NSW, it's $3 for every $100 for vehicles under $45,000. This upfront cost is a significant addition to the purchase price. Some dealers add it to the initial cost. If you buy through a private sale, you can avoid stamp duty.

Insurance

Third-party insurance is a legal requirement in Australia. It covers anyone who may get injured as a result of your driving. The cost varies depending on the type of vehicle and your personal circumstances.

You might also want to purchase car insurance to protect your vehicle against theft or other damage. Although, car insurance is not mandatory. If you’re tight on money, then you might choose not to insure your vehicle.

Ongoing Fees

Cars are expensive to run. You'll have to budget to cover maintenance, petrol, tolls, and repairs.

It's vital that you factor these expenses into your budget. While the lender may offer you $500,000 for a brand new car, is it sensible to borrow that much? You may find that the $500,000 covers the vehicle, but you lack the necessary funds to pay these additional costs. With a cheaper loan, you're more likely to be able to spare extra expenses comfortably.

How Long Does Car Finance Pre-approval Take?

So, you have found the loan you want and are ready to begin your application. Fortunately, as applying for your car loan online is so quick and easy, the pre-approval process doesn't take much time at all. It differs between lenders. However, a fast turnaround time would be one that's returned within the same day. Some lenders provide their response within a matter of minutes of completing your application.

Other lenders might take one or two days to offer a car loan pre-approval. This is especially the case with lenders that require you to contact them in person or via phone. However, the majority of lenders have up to date online approval systems.

You might expect the pre-approval process to take several days from start to finish. Therefore, it's sensible to begin your application sooner rather than later in order to get shopping. Getting pre-approval ahead of formal approval can shave time off the overall process.

What Happens After Pre-approval?

Once you have submitted your application, you'll receive either an approval or a rejection.

If your application is offered pre-approval, the following steps are to work towards formal approval. Firstly, once you have decided on your chosen car, you need to supply the details to the lender. With secured loans, lenders want to check that the vehicle is worth using as security. Cars older than seven or with other faults are often not eligible for secured loans.

Secondly, the lender will need to verify all your information and conduct a hard inquiry into your credit score. At this point, you will need to confirm the loan conditions. Then, the process of unconditional approval will begin.

However, this is still not a 100% guarantee that you will receive the finances. In some cases, the lender might withdraw their offer after the pre-approval stage. Typically, this is because something about your financial situation has drastically changed. For example, you might have lost your job and source of income. Or, if you take on new debt, your credit score will dip.

Another reason is that the lender finds an error in your application. This is why you must maintain complete transparency throughout your loan application. A car loan broker can help you build a trustworthy application.

How Long Do Pre-approvals Last on Car Loans?

Pre-approval is typically only valid for a specific time period. This limit varies from lender to lender. The typical length is between one and three months, the latter being the most common. Yet, many lenders only offer pre-approval for one month. This means that you need to find your car and submit your formal application within three months if you wish to proceed with the same lender.

Of course, you can go to other lenders after pre-approval. There is nothing to say you have to stay with the same lender.

If the pre-approval expires, you'll need to speak to the lender about re-approving your loan application. They will often extend pre-approval for another month or so.

What if Your Loan Is Declined After a Pre-approval?

In some cases, lenders will decline your loan application after pre-approval. There are a number of reasons why this might happen. Some of the common causes include:

- The car you're buying isn't eligible with your chosen loan or lender. This usually is true of used cars being too old or new cars being out of the price range.

- Your personal circumstances change. We mentioned job loss earlier. However, reduced wages or large expenditure elsewhere could also result in denied applications.

- Interest rates changed during the three months between receiving pre-approval and going ahead with the application. If they rise, then your ability to repay the loan could change.

- The lender modified its lending policy. Therefore, you'll have to be reassessed under the new terms.

If your loan application is rejected, it's crucial to speak to the lender about why this is the case. For example, if interest rates have changed, reapplying with the same income and credit score probably won't result in a changed response. You don't want to apply again only to be rejected - remember that a hard inquiry and denied loan applications negatively impact your credit score.

Whereas, if it's for a minor reason (e.g. loan terms have changed), then you might be able to apply again. But if it's for a more significant reason, you might need to apply for a loan with a different lender.

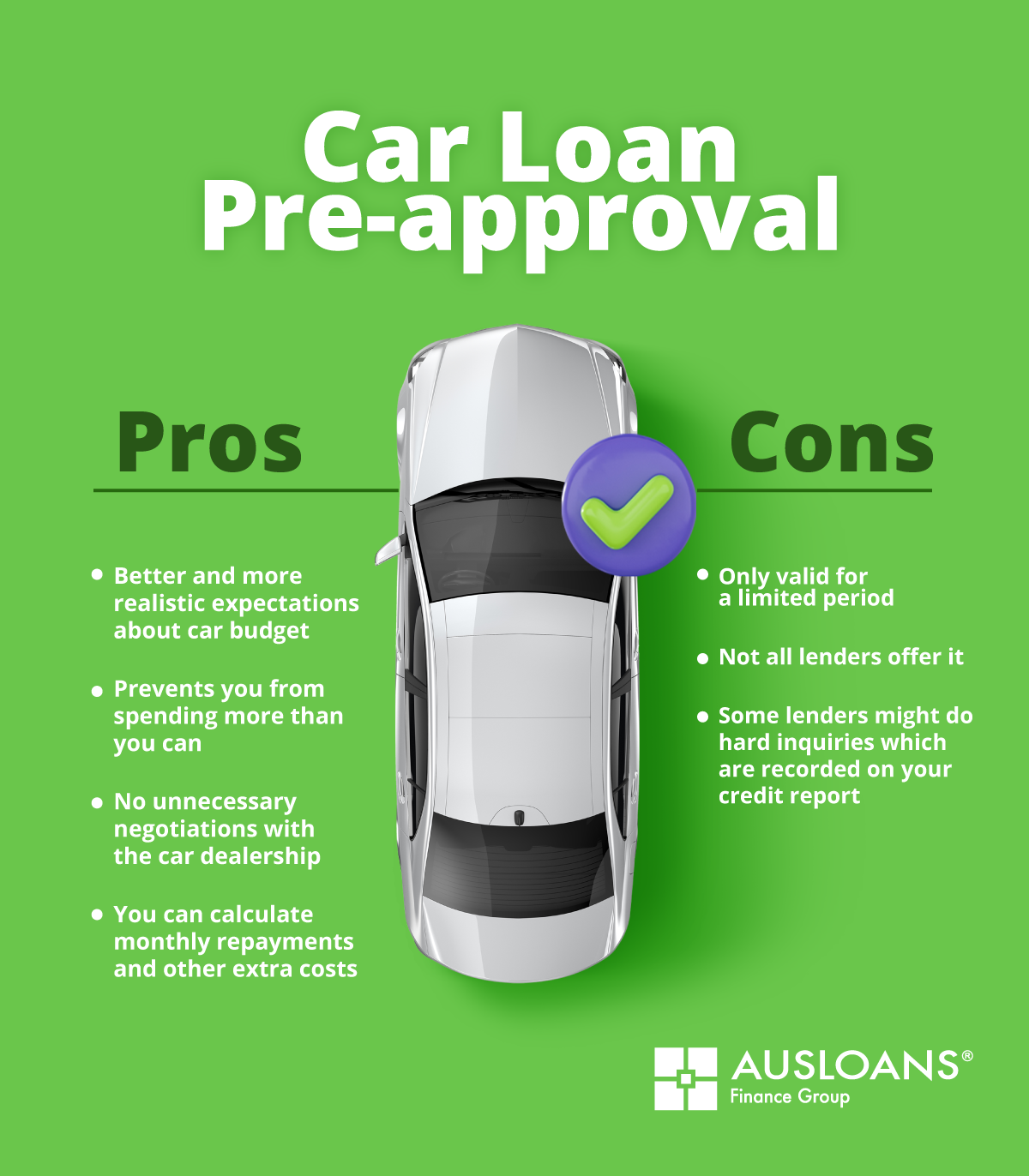

What Are the Pros and Cons of Car Loan Pre-approval?

Pre-approval is not a requirement. However, it's very sensible to find out your borrowing potential ahead of time. As with any financial decision, there are drawbacks as well as benefits. Here are some potential pros and cons to think about.

Pros of Car Loan Pre-approval

Here are the benefits of getting your car loan pre-approved:

- It can help you set realistic expectations about your price range and offer to buy a car with confidence. The lender will give you a quote for the loan amount.

- It can prevent you from spending more than you want to or can afford. Car dealers can be pushy and hard to resist when they offer you extended warranties and other features you don't want. You can't spend more than your loan amount with a set budget.

- It negates the need to negotiate loan terms with the dealer as you already have your finances sorted. This also avoids rolling a negative equity car loan into a new loan.

- With an idea of the interest rate and other loan terms, you can calculate your monthly repayments and begin to create a budget. Remember that you don't have to borrow the total amount. After factoring in additional expenses, it might be a good idea to borrow less.

Cons of Car Loan Pre-approval

Here are the drawbacks of getting your car loan pre-approved:

- It's usually only valid for a limited period. If you're not serious about buying a car, then the three months may run out before you have found your perfect vehicle. Then, you'll have wasted time and energy. It's best to wait until you're sure you want to purchase a vehicle within the next few months.

- Not all lenders offer pre-approval for car loans. You'll need to research whether or not your chosen lender does. Some just provide pre-qualification, which isn't as thorough as pre-approval. However, all Ausloans' lenders from its lender panel offer pre-approval, so you can

- The lender's credit check is usually only a soft inquiry for pre-approval. However, some lenders might conduct hard inquiries that are recorded in your credit report. This will be visible to future lenders and could impact your eligibility. If you have several loan applications on your record in a short time, this might not look good to prospective lenders.

How to Get Your Loan Pre-approved Today: Completing the Application Form

Getting pre-approved for a loan usually is very simple. At Ausloans Finance you can easily apply online ensuring a streamlined, straightforward process, and you'll receive an answer in minutes. Here is what you need to do to complete your application.

- Firstly, check your borrowing power by running a soft credit check to get your credit score. Is it good enough to secure you favorable interest rates? Ensure that there aren't any errors on your credit report that could negatively impact your application.

- Get all your supporting documents together. Alongside your credit score, you'll need to supply other financial documents to your lender. These might include your ID, recent payslips, bank statements, evidence of your employment status, and other assets and liabilities you have. For more information about qualification criteria and documents needed visit Ausloans knowledge hub.

- Have a shortlist of cars ready. While you probably haven't settled on your favourite car, it's sensible to know the rough make and model you would like. Even if the lender doesn't require details of your preferred vehicle, it'll help you complete your loan application before your pre-approval expires.

- Get started by completing our finance application, once submitted you will be contacted by our credit team that will guide you and answer all your questions through the whole process.

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

No Comments Yet

Let us know what you think