Share this

5 Tips To Prepare Your Portfolio as Interest Rates Continue to Rise

by Chris Hopkins on Oct 6, 2022 11:24:17 AM

Rising interest rates mean borrowers pay more money on their loans. The RBA sets the cash rate, which is currently 2.35%. This can influence the cost of borrowing and the interest rate when financial institutions lend money. But how much will rising rates affect you? And how can you prepare to limit the impact?

What Does an Interest Rate Rise Mean?

The RBA sets the cash rate on the first Tuesday of every month except January. The cash rate informs lender and bank interest rates. When the cash rate changes (up or down), financial institutions will raise or lower their rates accordingly.

When you hear that interest rates have gone up, it means that the RBA has increased the cash rate.

Since May 2022, the cash rate has dramatically risen. From November 2020 until May of this year, we enjoyed record low rates, at 0.1%, because of the pandemic. However, in normal circumstances, the cash rate fluctuates between 1 - 5%. Current rates are the highest they have been since December 2014, with the steepest rise since 1994.

What Happens When Interest Rates Rise?

Rising interest rates affect the economy in more ways than one. The RBA raises the cash rate to limit spending in times of inflation and encourage spending in a stagnant economy. Therefore, higher interest rates mean you'll receive more interest on your savings. Yet, it becomes more expensive to borrow money.

Banks and lenders do not have to follow the RBA's cash rate. However, most financial institutions will use the cash rate to inform their interest rates.

You might feel tempted to save your money in high-interest savings accounts. It's worth speaking to your bank about how interest rates will affect you.

Impact of Interest Rates Rise on Car Loans

When and if your car loan repayments are affected by interest rates changing will depend on what type of car loan you have, when it ends, and your lender. If you have a variable rate car loan linked to the RBA's cash rate, you will likely see an immediate impact on your car loan repayments when interest rates rise. You may already have noticed monthly repayments getting more expensive.

If you have a standard variable rate car loan, you will probably see an increase in line with interest rate rises. However, the increase depends on your lender, so it isn't a guarantee.

Speak with your lender if you are concerned about rising interest rates on your car loan. Alternatively, check the terms and conditions in your original document.

People with fixed-rate car loans will only see the effects if or when their current deal ends. If you're applying for a new car loan, consider taking out a fixed-interest rate loan to prevent further rate rises from affecting you.

Have a Financial Plan in Place

Having a finance plan to deal with potential interest rate changes is sensible. So far, we've seen relatively dramatic rate rises, and indicators suggest that the RBA will continue to increase the cash rate.

While a 0.25% or 0.5% rate rise might not set alarm bells ringing, it could have a significant impact. Moreover, several consecutive incremental raises might cost you a lot of money.

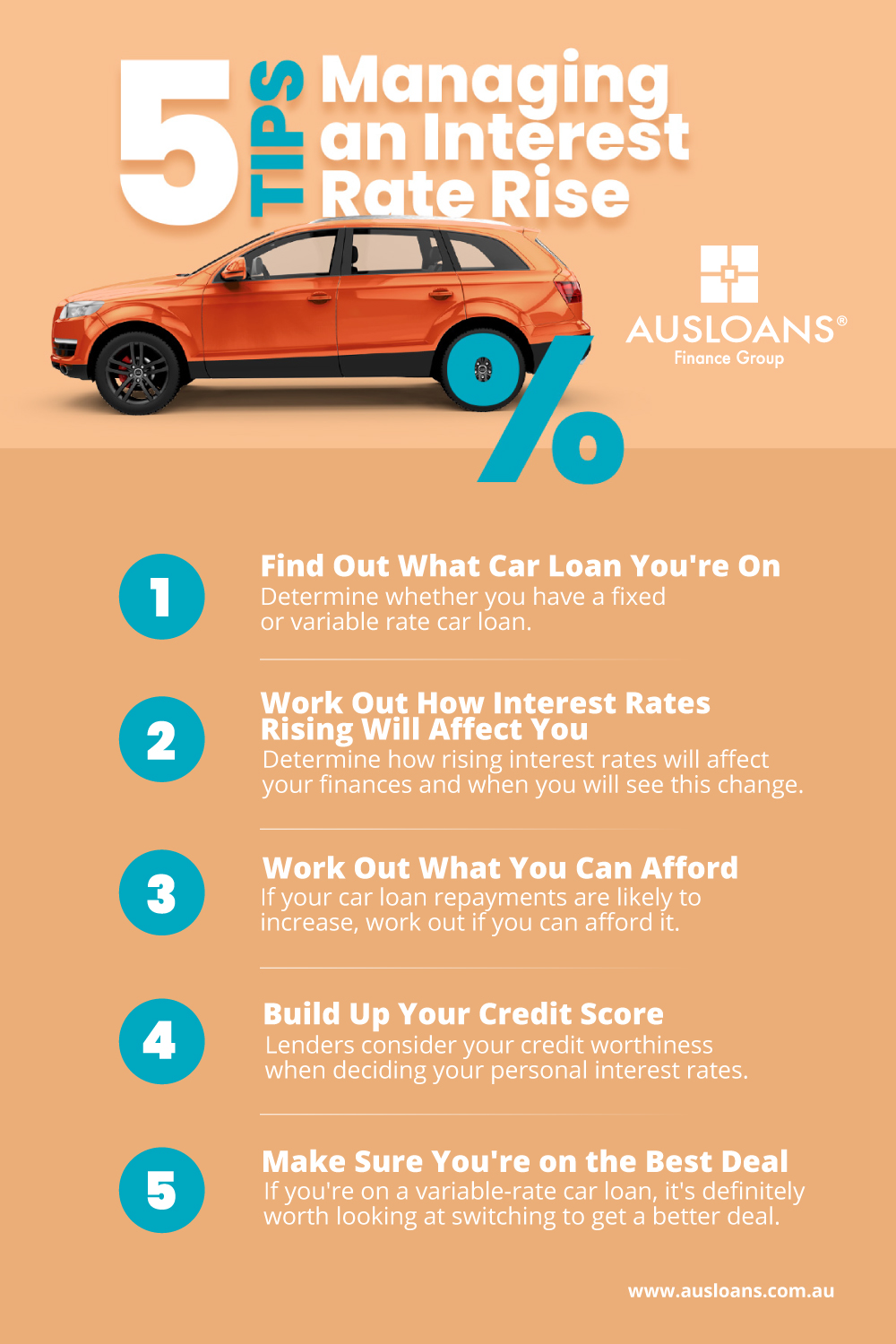

Five Tips for Managing an Interest Rate Rise on Your Variable Rate Car Loan

While no one can stop interest rates from rising, you can take a few steps to manage the impact on your car loan.

1. Find Out What Car Loan You're On

Determine whether you have a fixed or variable rate car loan. The type of loan you have will affect how much interest you will pay. Check your paperwork or speak to your lender if you don't know.

A variable rate loan fluctuates with the cash rate and will get more expensive as interest rates rise. A fixed-rate car loan means you pay the same monthly amount, regardless of whether the cash rate goes up or down.

If you currently have a variable rate car loan you might want to consider refinancing and switching to a fixed rate car loan.

If you haven't yet taken out a personal or car loan but think you might need financing soon, speak to a broker about your loan options. Applying for a fixed-rate car loan could save a lot of money as interest rates go up.

2. Work Out How Interest Rates Rising Will Affect You

Now you know what type of car loan you have—or which type you will apply for—you're in a better place to determine how rising interest rates will affect your finances and when you will see this change.

Use our car loan calculator to determine how the interest rate rise will affect you.

If you're yet to take out a loan, see if putting down a deposit may help reduce your payments in the future. In addition, many lenders offer better rates to borrowers with a deposit. When you show your ability to save, the lender will consider you a lower-risk borrower. Therefore, they might offer more competitive rates. Speak to your car loan broker about how you can find better rates.

3. Work Out What You Can Afford

If your car loan repayments are likely to increase, work out if you can afford it. It's a good idea to create a budget and check whether there are any areas or expenses you can cut back.

A good budgeting rule is to pay 50% of your earnings on essentials (e.g., rent, bills, and car loan repayments). Pay 30% towards non-essentials and 20% into savings. Can you reduce non-essentials to follow the 50, 30, 20 budgeting rule?

If there are likely to be further interest increases in the future (which seems likely), you might want to start building up a savings buffer so you can afford your car loan repayments when they hit.

On the other hand, if you're applying for a car loan, work out how much money you can afford each month. It might be worth lengthening your loan term or using your car as security to lower your monthly repayments. Alternatively, consider buying a cheaper car to alleviate the financial burden. Speak to a finance broker about your car loan options.

4. Build Up Your Credit Score

Lenders consider your creditworthiness when deciding your personal interest rates. Borrowers with a high credit score are low-risk and, therefore, benefit from lower interest rates. Those with a lower credit score are high-risk borrowers. Lenders often increase interest rates for high-risk borrowers to protect themselves should they default on loan repayments.

Building up your credit score is an excellent way to lower personal interest rates. If your credit score is better than when you first took out your car loan, speak to your broker about refinancing to get better rates.

You can boost your credit score by ensuring you don't miss any monthly repayments or make late payments. Additionally, ensure you have good credit utilisation and pay off credit card debts. If your credit score is very low, speak to a broker about loans for bad credit.

5. Make Sure You're on the Best Deal

If you're on a variable-rate car loan, it's definitely worth looking at switching to get a better deal. Even if you currently have a fixed-rate car loan, you should consider shopping around for more competitive rates elsewhere with better borrowing power. You might have to pay a few fees to refinance, but it could save you a lot of money on your monthly repayments.

Your finance broker will help you find the best loan deal available for your situation and talk you through the refinancing steps.

Impact of Interest Rates Rise on Borrowers

Rising interest rates may impact all types of credit, including personal loans, credit cards, or overdrafts in bank accounts.

Although not every credit product is directly linked to the RBA's cash rate, lenders will often increase rates in accordance with the market rate. You should receive notice before this happens. You may wish to refinance or overpay your loan payments to avoid rising rates.

If you are considering taking out a new loan or credit product after interest rates rise, you may find the cost of borrowing has gone up. To avoid further interest rate rises, it's sensible to take out a loan before rates increase again. Speak to your broker about locking in a fixed-rate car loan before rates rise.

Applying for a Car Loan

Taking on new credit products when interest rates rise might seem counterintuitive. However, you could get a highly competitive deal with sensible precautions and a broker by your side to shop around for the best rates.

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

No Comments Yet

Let us know what you think