Share this

How Much Will Car Loans Increase With an RBA's Cash Rate Rise [2023 UPDATED]

by Chris Hopkins on Jun 22, 2023 2:00:00 PM

Everyone might know that changes the Reserve Bank of Australia (RBA) makes to the Cash Rate will impact home loans, but can it have the same effect on your car loan?

Car loans, personal loans, and credit cards are not usually directly linked to the Cash Rate in the same way as some mortgages. However, many lenders increase or decrease their interest rates according to the market rate. So, how much will your car loan interest repayments increase with the RBA’s recent rate rise?

How Do RBA Rates Affect My Car Loan?

Interest rates on car loans and other credit products are generally proportional to the RBA’s Cash Rate The RBA sets the Cash Rate at the beginning of each month (except on January) to stabilise the economy. When the RBA’s Cash Rate is high (like it was during the financial crash of 2008), car loan interest rates will similarly go up.

In the same vein, car loan interest rates go down when the Cash Rate decreases—as it did in March 2020 with the pandemic. This month, June 2023, the RBA’s Cash Rate hit 4.10%. This is a sharp increase from the 0.1% we’ve enjoyed in the last few years. In fact, we’ve not seen the RBA's Cash Rate above 4% since April 2012, when it hit 4.25%.

The RBA’s Cash Rate is an indicator of the whole economy. So, when rates go up, wages and savings may similarly increase. While high-interest rates may sound alarming, they are a small part of the broader picture that explains Australia’s economy and health as a whole.

How Does the RBA's Cash Rate Work?

The RBA uses the Cash Rate to manage and stimulate investment in the economy. When the RBA Cash Rate is low, credit products are cheaper. Therefore, low interest encourages spending in a stagnant economy and prevents a recession. However, as the economy improves, interest rates will rise again.

Over the last few years, we faced a recession which led to record low Cash Rate of 0.1%. However, as the world returns to normality after the Covid-19 pandemic, the economy improves. Now, the rates are increasing, as expected. Since May 2022, when the Cash Rate was at 0.35%, we’ve seen a sharp increase to the current 4.10% rate.

When Will Interest Rates Rise?

Interest rates have been increasing incrementally since May 2022. For over a year, from November 2020 to April 2022, the RBA's Cash Rate remained at 0.1%. Since May 2022, the RBA has increased the Cash Rate by 0.25% or 0.5% each month.

Moreover, the RBA has warned¹ it will be some time yet before it is back in the target range.

However, banks and lenders don’t always raise their rates in sync with the RBA’s Cash Rate. So, while the market rate has increased dramatically, it doesn’t necessarily mean you will pay more interest on your car loan. Your lender may raise rates more slowly or more quickly. In some cases, the rising Cash Rate may not impact your car loan at all.

What Will Happen to My Car Loan Interest Rate?

Lenders use the RBA’s Cash Rate to inform their rates. However, the extent to which the Cash Rate affects your car loan will depend on the type of loan product you have.

A fixed-rate car loan means it has a fixed interest rate for the entirety of your loan term. Therefore, you will pay the same interest rate throughout your loan repayments, regardless of changes to the RBA rates.

If you haven’t yet taken out your car loan or are looking to refinance, the RBA changes may impact your car loan rate. It might be a good idea to apply for a low-rate loan while they are still available.

How Much More You Will Pay as RBA's Cash Rate Rises to 4.10%

Say you have a fixed-rate three-year loan at 7.5% with an outstanding balance of $20,000. Your car loan repayments or your car loan interest rate won’t change. However, if you wish to refinance, you might find other lenders’ rates increasing.

So, if you apply for a fixed-rate loan within the next months, you might find interest rates higher. That said, lenders determine rates by several factors, including car type, age, and borrowing power.

What Other Factors Determine Car Loan Interest Rates?

While the market rate informs interest rates, lenders will look at many other aspects of your application to offer specific rates to you.

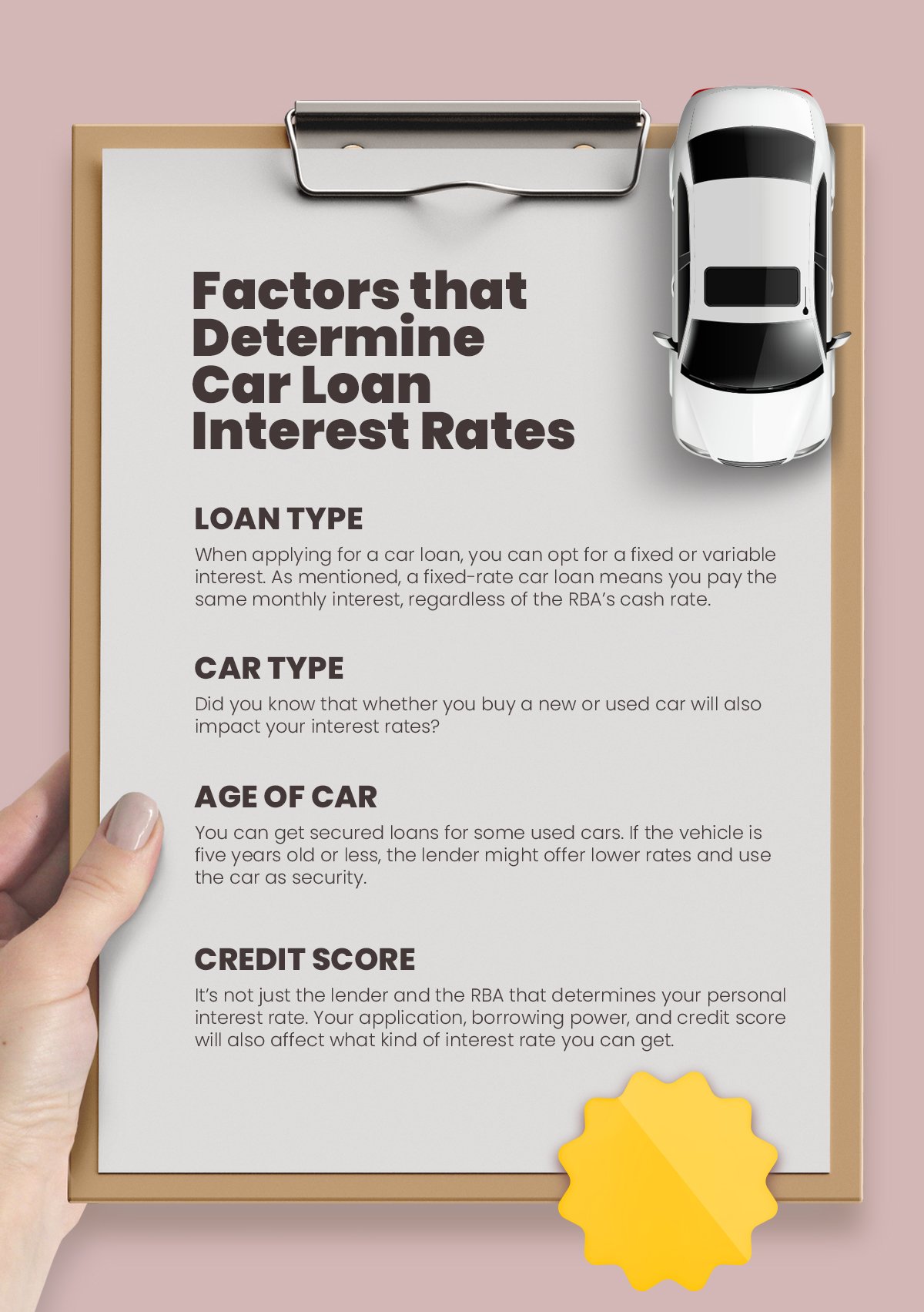

Loan Type

When applying for a car loan, you can opt for a fixed or variable interest. As mentioned, a fixed-rate car loan means you pay the same monthly interest, regardless of the RBA’s Cash Rate. On the other hand, a variable rate loan fluctuates with the Cash Rate. Therefore, your monthly interest repayments will also rise when the RBA increases the Cash Rate.

Variable rate car loans mean you could pay less interest when rates go down. However, fixed-rate loans protect you when rates go up.

How much your variable rate car loan is affected by RBA's Cash Rate depends on the specifics of your loan structure. Consider other car loan options when applying for financing while RBA's Cash Rate changes. Speak to a car loan finance broker to find out what loan products and interest rates are specifically available to you.

Car Type

Did you know that whether you buy a new or used car will also impact your interest rates? Lenders will offer a secured loan for new vehicles, meaning the car is collateral. If you fail to repay your loan, the lender has the legal right to claim the vehicle to cover losses. However, it often means you get a lower interest rate as secured loans are low-risk for the lender.

On the other hand, used cars are typically unsecured. While the upfront cost of the vehicle may be cheaper, you will probably pay a higher interest rate on any money borrowed. It’s worth calculating which car type is the most cost-effective to purchase. Use our car loan calculator to determine your potential monthly repayments and interest owed.

Moreover, consider buying an eco-friendly car or electric vehicle. You may be able to access government subsidies or green car loan options that have lower interest rates.

Age of Car

You can get secured loans for some used cars. If the vehicle is five years old or less, the lender might offer lower rates and use the car as security. Additionally, the price of used cars is relatively high. Speak to a broker about how the age of your car will affect your car loan interest rates and how to find competitive lenders to get a good deal.

Credit Score

It’s not just the lender and the RBA that determines your personal interest rate. Your application, borrowing power, and credit score will also affect what kind of interest rate you can get.

Your credit score reflects your history of borrowing money and repayments. Your score may dip slightly when you take on new debt, including credit cards or personal loans. Making on-time repayments proves you are responsible with money and will boost your credit score.

Over time, your score may fluctuate. Missed or late payments and rejected loan applications will severely hurt your score. Lenders will use your creditworthiness to determine whether you are a high-risk or low-risk borrower. Those with higher scores may enjoy lower interest rates and other loan features. You might struggle to find competitive interest rates if you have a bad credit score.

Before applying for a loan or refinancing, check your credit score. If there are any errors, ensure they’re fixed. Consider building up your score to get better interest rates. Alternatively, speak to a broker about bad credit loan options.

Calculating Interest Rates

While the RBA’s Cash Rate is going up, it doesn’t mean that your car loan interest rate will similarly increase. Depending on your loan structure, car type, and credit score, your interest rate may or may not get affected.

The 4.10% increase might seem intimidating, but it’s worth crunching the numbers yourself to see how much more you will pay. If you’re considering refinancing or applying for a new car loan, speak to a broker about your options before rates rise again. Locking in a fixed-rate car loan with low interest now might save you a lot of money when rates go up.

When Should I Take Out a Car Loan?

It might never seem like the right time to take out financing. However, as the RBA Cash Rate goes up, you will find average competitive interest rates increase. The extent to which RBA changes will affect car loans is unclear, but it’s worth locking in a low-rate loan while they are still widely available.

¹Statement by Philip Lowe, Governor: Monetary Policy Decision

Share this

- Car Loans (34)

- Car loan (12)

- Cars (9)

- EV (8)

- Electric Cars (7)

- Personal Loan (6)

- business loan (5)

- hybrid cars (5)

- Car Finance (4)

- EOFY (4)

- bad credit (4)

- caravan finance (4)

- chattel mortgage (4)

- car prices (3)

- interest rates (3)

- Holiday (2)

- credit score (2)

- family cars (2)

- summer (2)

- Caravan Loan (1)

- Caravan Loans (1)

- Equipment Loans (1)

- Future (1)

- Marine Finance (1)

- Tradies (1)

- car broker (1)

- caravan (1)

- caravan and camper sales (1)

- caravan parks (1)

- consumer finance (1)

- finance (1)

- finance approval (1)

- jet ski (1)

- new car (1)

- payday loans (1)

- April 2024 (4)

- March 2024 (6)

- February 2024 (5)

- January 2024 (3)

- December 2023 (6)

- November 2023 (7)

- October 2023 (5)

- September 2023 (6)

- August 2023 (4)

- July 2023 (5)

- June 2023 (2)

- February 2023 (1)

- January 2023 (4)

- December 2022 (4)

- November 2022 (1)

- October 2022 (5)

- September 2022 (1)

- July 2022 (4)

- June 2022 (3)

- May 2022 (3)

- April 2022 (2)

- March 2022 (3)

- February 2022 (4)

- January 2022 (2)

- December 2021 (1)

- November 2021 (3)

- October 2021 (3)

- September 2021 (7)

- August 2021 (4)

/Ausloans%20home/logos/Ausloans_logo_black.png?width=180&height=94&name=Ausloans_logo_black.png)

Comments (1)